Singapore New Property Launches 2026: In-Depth Analysis

January 6, 2026 | by nearme.sg

Executive Summary: 2026 Launch Playbook

When it comes to 2026’s launch wave, here’s your quick brief:

- OCR will dominate supply as new projects hit the market. Analysts expect roughly 15 to 40 launches spanning boutique builds to massive integrated hubs.

- This guide shows you how to navigate launches with a winning strategy, shortlist top-tier projects, and read the market dynamics like an insider.

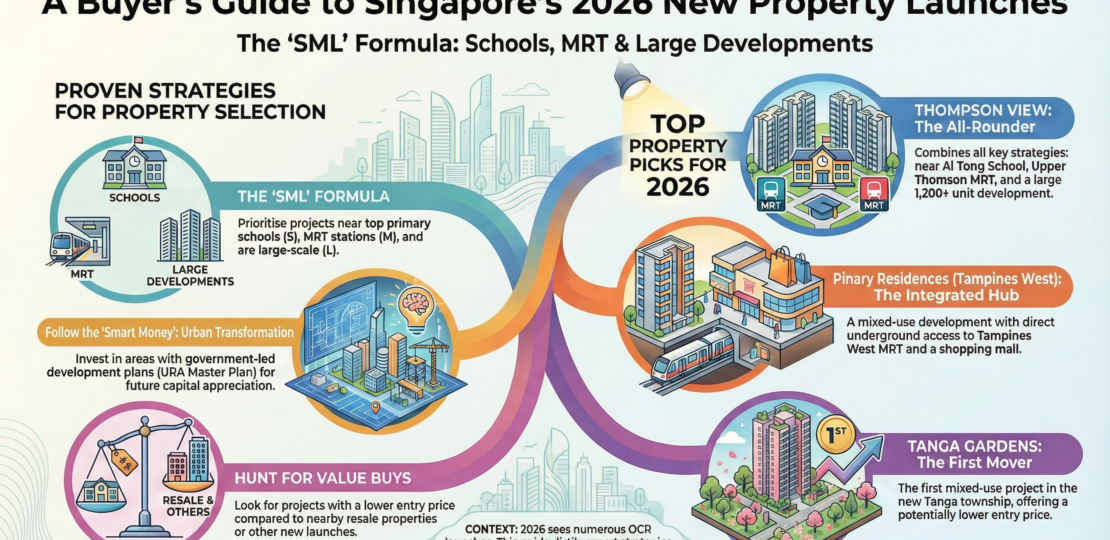

The 2026 Winning Formula: SML and GFA Harmonisation

- SML (Schools, MRT proximity, Large developments) is your go-to filter. These projects historically command stronger resale demand and a cleaner exit.

- GFA Harmonisation will shrink reported saleable areas (AC ledges excluded) — PSF may look higher, but entry quantum often comes down, which is great for HDB upgraders.

Top Picks to Watch

- Thomson View (D20): ~1,200+ units, minutes to Upper Thomson MRT; within 1km of Ai Tong School; Bright Hill set to be a CRL interchange — serious growth catalyst.

- Pinary Residences (Tampines St 94): Integrated mall + childcare + direct underground link to Tampines West MRT; analysts peg ~$2,300–$2,400 psf; within 1km of St. Hilda’s Primary.

- Lakeside Drive GLS & Tengah Gardens: JLD transformation tailwinds; Lakeside near MRT, Rulang Primary and Jurong Lake Gardens views; Tengah Gardens as first private condo in Tengah (est. ~$1,950–$2,000 psf) near future ACS (Primary) and the JRL.

- Bayshore Road GLS: First launch here in decades with pent-up demand, potential sea views, and direct Bayshore MRT/East Coast Park access — a more attainable East Coast lifestyle versus D15.

Pricing and Entry Strategy

- Land costs are normalising. Value pockets exist (e.g., Nara Residences at Dairy Farm with 3BR from ~S$1.6M+), while scarcity plays like River Modern (River Valley) could exceed S$3,000 psf.

- Avoid overpaying: Category A developers (e.g., GuocoLand, Hong Leong) tend to raise prices progressively; Category B can spike aggressively — Phase 1 entry is typically safest.

Market Dynamics to Watch

- Even with ~6,600 OCR units projected, 2025’s strong take-up shows demand is resilient. If rates ease, an oversupply narrative can flip to shortage quickly — lifting both launch and resale prices.

- Think marathon, not sprint: study the Master Plan (terrain), use SML (gear), and time your entry (Phase 1) to pull ahead.

Looking at Singapore’s property landscape in 2026, you’re witnessing what could be the most exciting launch pipeline in recent years. With 20 private residential projects and 5 Executive Condominiums hitting the market, this year is shaping up to be a game-changer for both investors and upgraders.

Market Outlook 2026: What the Numbers Are Telling Us

When it comes to understanding where the market’s heading, the data is pretty compelling. The momentum from 2025’s stellar performance has set the stage beautifully – LyndenWoods achieved a jaw-dropping 94.5% take-up rate in July, while River Green saw 88% of units snapped up in August. Even more impressive? Both Penrith and Skye at Holland exceeded 97% take-up rates by October.

Core Central Region (CCR) continues to command premium prices, with most projects easily crossing the S$2.5 million mark per unit. Limited land supply in prime areas means developers are getting creative with smaller sites while maximizing value propositions.

Rest of Central Region (RCR) is where the real action’s happening. You’re seeing mega-developments like Thomson View spanning 540,000 sq ft, offering that sweet spot between accessibility and exclusivity. Price points here typically range from S$1.8 to S$2.3 million for family-sized units.

Outside Central Region (OCR) remains the volume leader, with projects like Chuan Grove delivering over 1,000 units. These developments are targeting the HDB upgrader segment aggressively, with quantum prices often starting below S$1.5 million.

The 2026 Winning Formula: SML and GFA Harmonisation

- What to prioritise (SML): Schools within 1km, MRT within a short walk, and Large developments (think 800–1,000+ units for robust facilities and resale liquidity).

- Why it works: These features directly influence family demand, tenant convenience, and exit strategy — the trifecta for value retention.

- GFA Harmonisation in plain English: AC ledges are out of saleable strata area. You’ll see higher PSF, but layouts are more efficient and total quantum can be lower.

- Action steps:

- Shortlist by SML first, then drill down into stack and facing.

- Compare PSF vs quantum — don’t reject a deal just because the PSF looks high post-harmonisation.

- Review floorplans for usable space (bay windows and oversized planters are out; efficiency is in).

Spotlight: Key Launches That Deserve Your Attention

Thomson View – The Marymount Marvel

Picture this: a massive 540,000 sq ft development with superb TEL connectivity — minutes to Upper Thomson MRT — plus unblocked southern views. Thomson View isn’t just another launch; it’s positioning itself as the flagship of the Thomson corridor transformation and is widely tipped to be one of 2026’s largest launches with 1,200+ units. The unit mix leans toward 2- and 3-bedders, perfect for young families upgrading from HDB flats.

Why it’s a top contender (SML-ready):

- Schools: Within 1km of Ai Tong School — a perennial favourite for families.

- MRT: Upper Thomson (TEL) nearby; Bright Hill will become a Cross Island Line interchange, unlocking rapid West-side access.

- Large-scale: 1,200+ units means fuller facilities, better maintenance economies, and stronger resale liquidity.

What this means for your numbers:

- Expect pricing to hover around S$1,800–S$2,000 psf based on recent area comps.

- Thanks to GFA Harmonisation, PSF may look higher, but improved efficiency can keep your entry quantum competitive.

Pinary Residences (Tampines Street 94) – Integrated, Family-First

For starters, this Tampines West integrated development is the real deal for convenience seekers.

- Integrated features: A commercial mall, a childcare centre, and a direct underground link to Tampines West MRT mean daily life is plug-and-play.

- Pricing edge: Analysts expect a benchmark ~$2,300–$2,400 psf — reasonable for an integrated hub in a mature town.

- SML appeal: Within 1km of St. Hilda’s Primary; MRT at your doorstep; sizeable integrated ecosystem that draws long-term family demand.

Lentor Central Plot 4 – Last Call for Lentor

If you’ve been following the Lentor story, this is your final chapter. With around 580 units and proximity to Lentor MRT Station, this represents the last major residential piece of the Lentor master plan puzzle. The area’s transformation from industrial to residential has been nothing short of spectacular.

Early indications suggest a balanced unit mix, though 3 and 4-bedroom configurations are expected to dominate given the family-oriented positioning of the Lentor precinct.

Lakeside Drive GLS & Tengah Gardens – West-Side Momentum

The West is buzzing, anchored by the Jurong Lake District (JLD) transformation.

- Lakeside Drive: A rare site near Lakeside MRT and top-tier Rulang Primary, with unblocked views across Jurong Lake Gardens — perfect for families chasing both schooling and lifestyle.

- Tengah Gardens (First private condo in Tengah): A strategic first-mover with an estimated ~$1,950–$2,000 psf entry, near the future ACS (Primary) campus and the Jurong Region Line — ideal for buyers who want growth plus affordability.

Bayshore Road – The 27-Year Wait is Over

Here’s the East Coast wildcard you’ve been waiting for. Bayshore is the first condo launch here in decades and is set to unleash serious pent-up demand.

- Lifestyle: Potential sea views, car-lite living, and direct access to Bayshore MRT and East Coast Park.

- Market position: A more attainable entry point for buyers who want the East Coast lifestyle but are priced out of D15.

- Scarcity kicker: First-mover advantage in a precinct that hasn’t seen a private launch since 1997.

Tengah Garden Avenue EC – Singapore’s First “Forest Town”

For Executive Condominium buyers, Tengah Garden Avenue is stealing the spotlight with its ambitious sustainability credentials. The marketing tagline of Singapore’s first “Forest Town” isn’t just clever branding – the development genuinely prioritizes green living and innovative technology integration.

The competitive pricing structure makes it particularly attractive for HDB upgraders who want to embrace environmental responsibility without breaking the bank.

Pricing Trends and Strategy

Let’s talk numbers — and how to play them.

- Normalising land prices: Expect a wider spread of launch PSFs. Value pockets like Nara Residences (Dairy Farm) could see 3BR starting from ~S$1.6M+, while scarcity zones such as River Modern (River Valley) may cross S$3,000 psf.

- How to avoid overpaying:

- Check the developer’s playbook. Category A developers (e.g., GuocoLand, Hong Leong) typically lift prices in steady, progressive steps — late-queue buyers won’t face outsized jumps.

- Category B developers can hike aggressively as sales accelerate. If you like the fundamentals, Phase 1 (Launch Day) entry is usually your safest move.

- Practical tip: Benchmark your target stack against competing launches nearby (PSF, quantum, maintenance fees), not just headline prices.

YouTube Insights: What the Experts Are Saying

Diving deep into property analysis videos from channels like Singapore Property TV, Prelaunch SG, and CondoNewLaunches reveals some fascinating insider perspectives that you won’t find in mainstream media coverage.

Market Sentiment Analysis: The overwhelming consensus from property YouTubers is cautious optimism. While 2025’s strong performance has created positive momentum, there’s recognition that sustaining 90%+ take-up rates throughout 2026 might be challenging. The key differentiator? Projects with genuine value propositions beyond just location.

Buyer Behavior Shifts: Several channels highlight how stricter loan policies are actually creating a healthier marketplace. Speculative buying has cooled significantly, meaning genuine owner-occupiers and long-term investors are driving demand. This shift favors developments with strong lifestyle components over pure investment plays.

Regional Preferences: Video analysis consistently shows RCR emerging as the sweet spot for 2026. CCR prices have reached levels that price out many upgraders, while OCR developments often lack the prestige factor that drives capital appreciation. RCR projects like Thomson View and Upper Thomson Parcel A offer that goldilocks positioning.

URA Plans and Government Strategy Impact

The government’s strategic planning is reshaping multiple corridors simultaneously, creating both opportunities and challenges for property buyers.

Kampong Bugis Transformation: This massive urban renewal project is creating ripple effects across the Central region. Properties within walking distance of future Kampong Bugis developments are likely to see significant capital appreciation as the area transforms into a mixed-use cultural and commercial hub.

Supply Pipeline Management: URA’s measured approach to land releases means supply remains controlled, supporting price stability. However, the 25 total launches planned for 2026 represent a significant uptick from recent years, potentially creating more choice for buyers.

Rental Yield Context: With the rental market showing signs of stabilization after years of rapid growth, new launches are increasingly focusing on owner-occupation rather than pure investment appeal. This shift is evident in unit sizing trends and amenity planning.

Market Dynamics: Supply vs. Demand

You’re in a market that could pivot fast.

- OCR supply: Over 6,600 units may hit in 2026, but 2025’s blockbuster take-up shows genuine demand from upgraders and long-horizon investors.

- Rate sensitivity: If interest rates ease, watch the narrative flip from oversupply to shortage — pushing both new-launch and resale prices higher.

- Actionable playbook:

- Prioritise SML projects to protect exit liquidity.

- Secure Phase 1 pricing on high-conviction launches.

- Keep pre-approval tight — be ready to execute when ballots open.

Think marathon, not sprint: the buyers who study the terrain (Master Plan), gear up right (SML), and pace their entry (Phase 1) tend to finish ahead with stronger gains.

Investment Analysis: Winners and Opportunities

For Investors: Where the Smart Money is Going

Undervalued Opportunities: Bayshore Road stands out as potentially undervalued given its 27-year scarcity premium and planned infrastructural improvements. The East Coast corridor has historically shown strong capital appreciation cycles.

High Demand Predictors: Projects with direct MRT connectivity are commanding premium interest. Thomson View and Upper Thomson Parcel A both benefit from this crucial advantage, making them safer bets for capital growth.

Yield Considerations: OCR developments like Chuan Grove offer better rental yields due to lower quantum prices, making them attractive for investors prioritizing cash flow over pure capital gains.

For Upgraders: Strategic Considerations

Timing Advantages: The current market offers upgraders genuine choice – something that wasn’t available during the supply-constrained years of 2022-2023. You can actually compare multiple projects in similar price ranges before committing.

Family-Friendly Features: Developments like Lentor Central Plot 4 and Thomson View prioritize family amenities and educational proximity, making them ideal for growing families upgrading from HDB flats.

Future-Proofing: Projects embracing sustainability and smart home technology, particularly Tengah Garden Avenue EC, offer longer-term value as environmental standards become increasingly important to future buyers.

Regional Deep Dive: Where to Focus Your Attention

North-East Corridor: Chuan Grove’s massive scale offers economies of scale that should translate to competitive pricing and comprehensive facilities. The Serangoon connectivity makes it attractive for both local and international buyers.

Thomson Belt: This is where multiple mega-developments are creating a new residential ecosystem. Thomson View and Upper Thomson Parcel A are essentially competing to define the character of this emerging district.

Eastern Developments: Bayshore Road’s uniqueness makes it a wildcard that could deliver outsized returns if the East Coast transformation accelerates as planned.

The 2026 Singapore property market is offering something we haven’t seen in years: genuine choice across all price segments and regions. Whether you’re an investor seeking the next growth catalyst or an upgrader finally ready to make the leap from HDB living, this pipeline delivers options that cater to diverse needs and budgets.

Key Sources and Further Analysis:

- Singapore Property TV’s “2026 Launch Pipeline Analysis” series

- Prelaunch SG’s monthly market updates and booking day coverage

- CondoNewLaunches’ comparative pricing analysis videos

- URA’s official GLS program announcements and master planning documents

For comprehensive property investment insights and local service recommendations, explore more resources at NearMe.SG.

RELATED POSTS

View all