Pokémon TCG Investment 2026: Best Sealed Product Sets Free Guide

February 8, 2026 | by nearme.sg

![[HERO] Pokémon Sealed Product Investment Guide 2026: Why Sword & Shield is the New King](https://nearme.sg/wp-content/uploads/2026/02/k-LrzH8zRsL.webp)

Look, let me be straight with you, if stocks and crypto have been giving you anxiety attacks, it might be time to look at something a bit more… nostalgic. Pokémon sealed products have quietly become the blue-chip investment that Wall Street bros wish they’d discovered first. We’re talking about the most meticulously managed intellectual property on the planet, with decades of proven demand and a collector base that makes sneakerheads look like casual hobbyists.

And here’s the kicker for 2026: while everyone’s been obsessing over the shiny new Scarlet & Violet sets or chasing the vintage Base Set dream, Sword & Shield has been sitting in the corner like an undervalued stock about to explode. Let’s break down why this era is about to make serious money moves this year.

Why Pokémon is the Investment Blue Chip You Can Actually Afford

When it comes to collectibles, Pokémon isn’t just playing the game, it’s literally the rulebook. The Pokémon Company has mastered the art of controlled releases, nostalgia marketing, and keeping demand perpetually higher than supply. Unlike comic books that reprint whenever sales dip, or trading card games that fold after five years, Pokémon has maintained cultural relevance for nearly three decades.

The beauty of sealed product investing? You’re not gambling on a single card’s condition or betting that your Charizard doesn’t have a micro-scratch that drops it from PSA 10 to PSA 9. You’re investing in an unopened time capsule that only appreciates as the years roll by. Picture this: someone in 2016 bought Sword & Shield booster boxes for $90-100. Those same boxes? They’re now pushing $200-250, and we’re just getting started.

Sword & Shield: The Sleeping Giant Waking Up in 2026

Here’s where things get spicy. Sword & Shield is positioned to be the percentage growth winner of 2026, and it’s not even close. While everyone’s been distracted by the new releases, this era has been quietly drying up in the secondary market.

Let’s talk numbers. Sword & Shield had a massive print run (thanks, pandemic lockdown demand), but here’s the catch, so much of it got ripped open. Remember 2020-2021? Everyone was at home opening packs on TikTok and YouTube. The opening frenzy was real. What that means now is that sealed product is becoming genuinely scarce, especially for sets like Evolving Skies, Chilling Reign, and the absolute monster of the era, Fusion Strike.

Fusion Strike deserves its own paragraph because, holy smokes, this set was clowned on when it released. “Too many cards! No chase cards! Skip it!” Yeah, well, those “skip it” booster boxes are now solid holds because the print run was shorter than people realized, and sealed quantities are vanishing. When everyone ignores a set, that’s when the smart money moves in.

Then there’s Silver Tempest, the set that gave us the Lugia that made grown adults cry when they pulled it. This set has serious legs for 2026 growth because it balanced playable cards with absolute banger chase cards. If you can still find sealed Silver Tempest at reasonable prices in Singapore, grab it before the market fully wakes up.

Sun & Moon: When “Vintage” Becomes “Elite”

Sun & Moon isn’t just vintage anymore, it’s entering elite territory, and the price tags are starting to reflect that reality. We’re talking booster boxes that now command $400-600 for sets like Cosmic Eclipse and Team Up. Yeah, you read that right.

Here’s the thing: Sun & Moon is pricing people out, but that doesn’t mean it lacks upside. It absolutely still has room to run, especially for sealed product. The era gave us some of the most beloved modern cards (shoutout to the Tag Team GX cards), and nostalgia for this period is just starting to kick in hard.

If you got in early on Sun & Moon, congratulations, you’re sitting pretty. If you’re looking to get in now, you need deeper pockets, but sets like Unbroken Bonds and Unified Minds still offer solid growth potential. Just don’t expect the explosive percentage gains that Sword & Shield is about to deliver.

Scarlet & Violet: The Entry Point with a Warning Label

Want to get into Pokémon sealed investing but don’t have $300 to drop on a single booster box? Scarlet & Violet is your entry ticket. Current sets like Obsidian Flames and Paldean Fates are still available at or near retail, making them accessible for newer investors.

But here’s the reality check: watch out for high population. The Pokémon Company learned from Sword & Shield’s success and cranked up production. More sealed product in circulation means slower appreciation. That doesn’t mean Scarlet & Violet won’t grow, it absolutely will, but we’re looking at a 5-7 year hold rather than the 2-3 year explosive growth some Sword & Shield sets might deliver.

The smart play? Focus on special sets and premium products. Pokémon Center exclusive ETBs, Ultra-Premium Collections, and limited-run promos will always outperform standard booster boxes because of lower print quantities and higher collector demand.

The Japanese Sealed Warning: Proceed with Extreme Caution

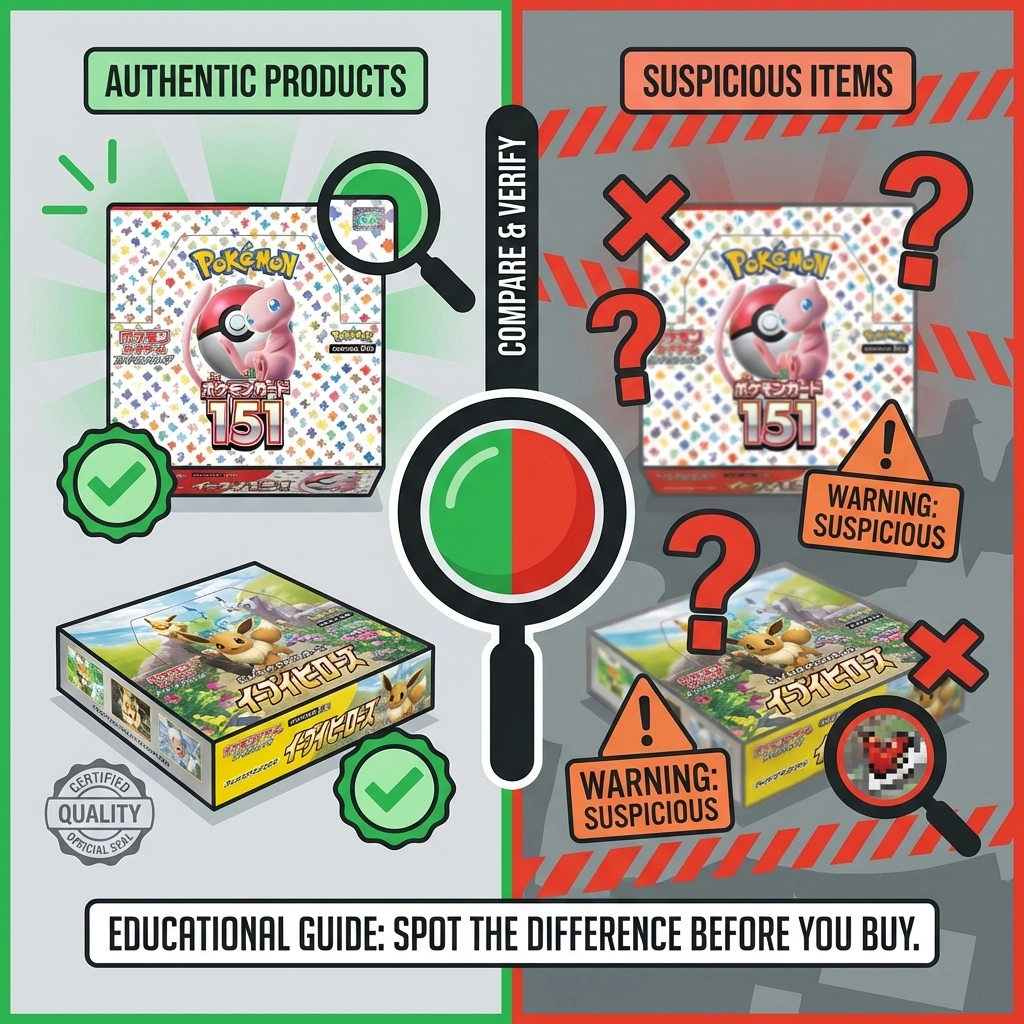

Okay, time for some real talk about Japanese sealed products. The market is absolutely flooded with resealed boxes and fake products. I’m not saying don’t buy Japanese, I’m saying be paranoid about it.

If you’re going to invest in Japanese sealed, stick to these rules:

- Only buy from ultra-reputable sources. We’re talking established retailers with verified track records.

- Focus on top-tier sets like 151 or Eevee Heroes. These sets have proven demand and are less likely to be faked (though fakes still exist).

- If the price seems too good to be true, it’s fake. Full stop.

The Japanese market can offer incredible returns, Eevee Heroes sealed boxes have gone absolutely bonkers, but one fake product can wipe out gains from five real ones. Be careful out there.

The Math of Sealed: Why Opening is (Usually) Losing

Let’s get into the cold, hard math that every sealed investor needs to understand. Opening sealed products typically results in a 10-20% loss compared to just holding the sealed product. Yes, even if you pull decent cards.

Here’s why: when you open a booster box, you’re hoping to beat the expected value (EV) of the box. But EV is calculated at retail prices, and you’re selling into a market where everyone else is also opening boxes. You’re flooding supply. Meanwhile, sealed products have historically grown 15-35% annually when held long-term.

The only time opening makes sense is if you’re a content creator making money from the opening itself, or if you genuinely just want to enjoy opening packs (which is totally valid, this is supposed to be fun, remember?).

But if your goal is investment returns, keep those boxes sealed. Every box you don’t open is a box that increases in scarcity.

PSA is Still the King, Don’t Be Foolish

If you do decide to crack packs hunting for singles to grade, here’s the golden rule: PSA is still the king of liquidity. Don’t crack PSA 10s to send to other grading companies, no matter what the hype says.

Yes, CGC has its fans. Yes, BGS 10s with subgrades are beautiful. But when it’s time to sell, PSA 10s move faster and often for more money because the market trusts the brand. Liquidity matters more than you think, especially if you need to exit a position quickly.

Sets to Watch in 2026: The Shopping List

Alright, let’s get specific. If you’re building a sealed investment portfolio for 2026, here are the sets that should be on your radar:

Sword & Shield Era:

- Fusion Strike – The contrarian play that’s about to pay off

- Silver Tempest – Lugia hype isn’t going anywhere

- Evolving Skies – Already strong, room to run

- Chilling Reign – Underrated and underpriced

Special Mention:

- Destined Rivals (if you can find it) – Small print run, high demand

- The upcoming Mega Evolution: Ascended Heroes – New release with serious buzz

The Mega Evolution set launching in early 2026 is particularly interesting because it ties into Pokémon Legends: Z-A hype. Whenever Pokémon coordinates releases with video games, sealed products from those eras tend to outperform.

The Moonbreon Factor: Thrill vs. ROI

We need to talk about the elephant in the room: or should I say, the Umbreon. The “Moonbreon” from Evolving Skies (Umbreon VMAX Alternate Art) has become the chase card that makes people do irrational things.

Here’s the reality: the thrill of potentially pulling a Moonbreon is real, but the ROI math doesn’t support opening boxes to chase it. You’re statistically better off buying the single if you want it, or holding sealed if you want investment returns.

But I get it. The gambler’s rush is part of the hobby. Just don’t fool yourself into thinking you’re making sound investment decisions when you’re really just scratching the lottery ticket itch. Both can coexist: just be honest about which one you’re doing.

The play for investors? Focus on English sealed products for maximum international liquidity, but don’t sleep on limited Japanese releases that can be verified authentic. The key is building relationships with reputable local game stores that have direct distributor connections.

Final Thoughts: Play the Long Game

Pokémon sealed investing isn’t a get-rich-quick scheme: it’s a get-richer-slowly strategy. The sets that deliver the biggest returns are the ones you bought and forgot about for 3-5 years. Sword & Shield is positioned to be the star performer of 2026 because it sits in that sweet spot: old enough to be scarce, new enough to be affordable, and full enough of chase cards to maintain demand.

Keep your boxes sealed, store them properly (climate control matters!), diversify across multiple sets, and for the love of all that is holy, stop opening everything. Your future self will thank you when those Fusion Strike ETBs you bought for $300 are selling for $600 in 2029.

Now if you’ll excuse me, I have some Silver Tempest ETBs to hide from myself before the urge to open them becomes too strong. The struggle is real, folks. The struggle is real.

RELATED POSTS

View all