Vela Bay at Bayshore Review: Free Expert Guide 2026

February 7, 2026 | by nearme.sg

When it comes to East Coast living, everyone talks about the sea breeze and the weekend laksa runs. But for the savvy investor in 2026? The conversation stops at one word: Bayshore. And when we zoom into the Bayshore precinct, there’s one project commanding all the attention, Vela Bay by SingHaiyi.

Here’s the thing: Vela Bay isn’t just another shiny new launch. It’s the first-ever private residential development in the government’s sprawling 60-hectare Bayshore master plan. That’s right, you’re looking at prime first-mover positioning in what’s essentially a brand-new neighborhood. But is that land cost of $1,388 PSF PPR a steal, or are we staring down an overpriced hype train? Let’s talk numbers.

The Project Snapshot: What You’re Actually Buying

Vela Bay sits on a prime plot along Bayshore Road, and it’s not messing around. We’re talking about:

- ~515 residential units across two 30-storey towers

- 1 to 5-bedroom layouts (yes, penthouses included)

- 99-year leasehold (awarded March 2025)

- Direct connection to Bayshore MRT Station (literally a 1-minute walk)

- Estimated TOP in 2029-2030

The nautical-inspired design is SingHaiyi’s attempt at resort-style living: think yacht-club vibes with floor-to-ceiling windows, smart home tech, and that obligatory infinity pool overlooking the East Coast skyline. It’s the kind of place where your Zoom background game goes from zero to hero.

But here’s where it gets interesting. Unlike boutique developments that try to “preserve exclusivity” with 200 units, Vela Bay hits the sweet spot at 515 units. Why does that matter? Two words: transaction volume and MCST fees.

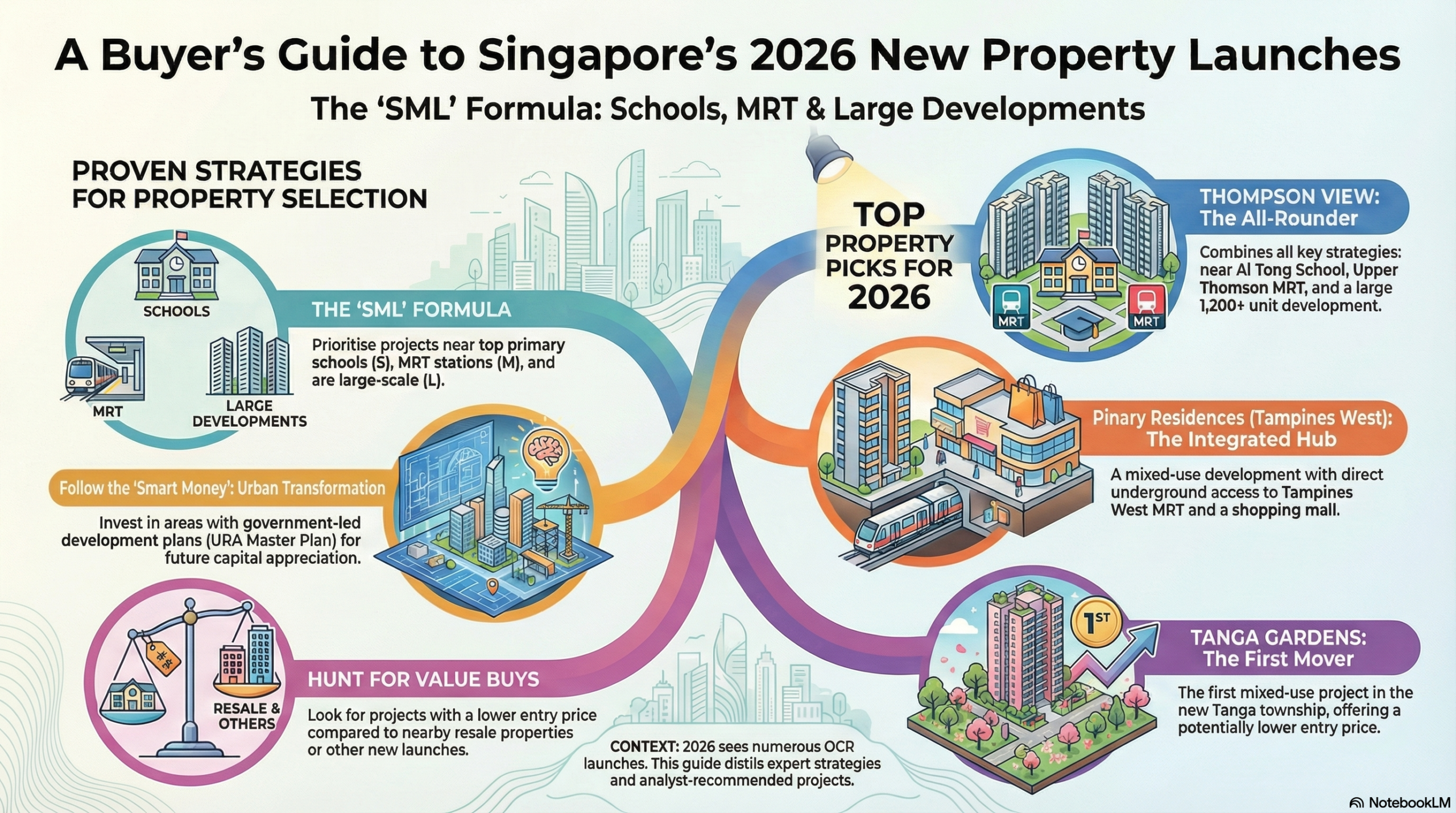

Location Deep-Dive: The SML Framework (Schools, MRT & Liveability)

S: Schools That Actually Move the Needle

(And yes, this is where the “L” quietly matters too.) Vela Bay’s ~515-unit size is a practical investor advantage inside the SML lens: more resale activity = better price discovery and liquidity, and more households sharing costs = typically lower per-unit MCST fees versus small boutique condos. In real life, that can mean an easier exit when you sell—and a less painful monthly maintenance line item while you hold.

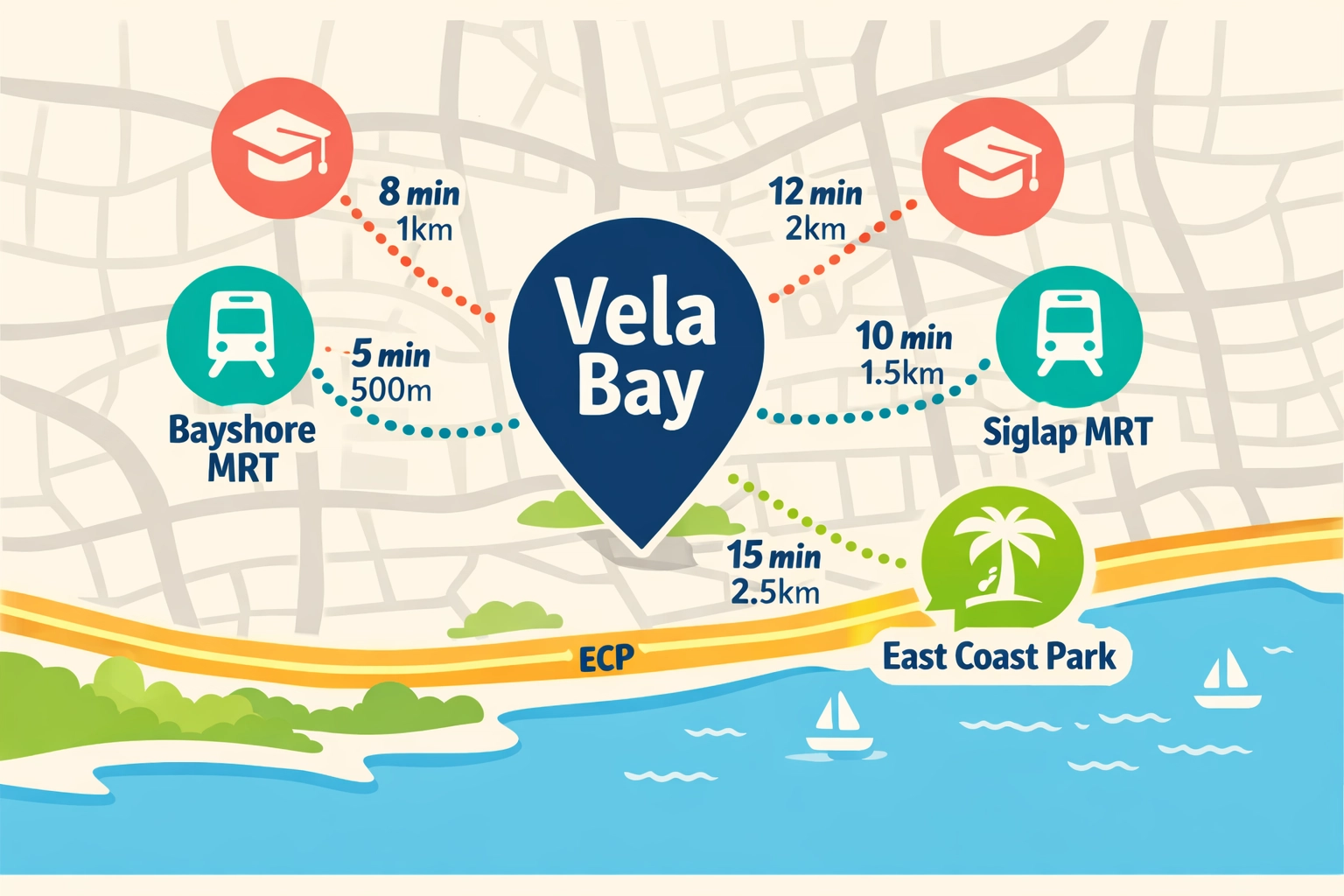

You’re within 1km of Temasek Primary School: a perennial favorite among young families in District 16. Beyond that, you’ve got:

You’re within 1km of Temasek Primary School: a perennial favorite among young families in District 16. Beyond that, you’ve got:

- Victoria School (2.5km)

- Temasek Junior College (2.8km)

- CHIJ Katong Primary (3km)

For parents targeting the 1km priority admission phase, Temasek Primary alone makes Vela Bay a no-brainer. And if you’re an investor? Family tenants = longer lease tenures and fewer void periods.

M: MRT Access That Defines Your Commute

Here’s where Vela Bay really flexes. You’re looking at a 1-minute walk to Bayshore MRT on the Thomson-East Coast Line (TEL). Now, double-check these travel times because they’re the kind of numbers that change how both tenants and buyers value the project:

- Bayshore → Shenton Way (CBD): ~20 minutes, direct on TEL (no transfers)

- Bayshore → Orchard: ~30 minutes, direct on TEL (no transfers)

- Bayshore → Marina Bay: ~18 minutes

That “no transfer needed” part is a major selling point if you’re viewing this as an investor (stronger tenant pull, less pushback on rent) or as an office worker (predictable commute, fewer delays). In Singapore, direct rail access to both CBD + Orchard is exactly the kind of convenience that tenants pay a premium for.

Compare that to older East Coast condos like Costa Del Sol (15-minute walk to Marine Parade MRT) or The Bayshore (pre-TEL, you’re looking at a bus ride). The TEL connectivity alone adds a 10-15% premium to comparable resale units in the area.

And for tenants? MRT proximity is the #1 search filter on PropertyGuru. You’re cutting your void period by weeks, if not months.

Pricing Reality Check: The $1,388 PSF PPR Baseline

SingHaiyi paid $658.9 million for the land: that’s $1,388 PSF PPR (per plot ratio). For context, that’s higher than the 2024 Tampines BTO land bids but 10-15% cheaper than prime District 15 plots.

So what does that mean for your entry price? Based on typical developer margins (30-35%), you’re looking at:

- Estimated launch price: $2,500 – $2,700 PSF

- 2-bedroom units: ~$1.6M – $1.8M

- 3-bedroom units: ~$2.2M – $2.5M

- 4-bedroom units: ~$3M+

Let’s be real: that’s not cheap. But here’s the kicker: comparable resale units at The Bayshore (a 1996 development) are transacting at $1,800-$2,000 PSF in Q1 2026. If you’re paying a 25-30% new-launch premium, you’re betting on:

- Capital appreciation from the Bayshore precinct transformation

- Rental yield from the 7,000 HDB households moving in (built-in tenant base)

- First-mover advantage before the next 2 private launches crowd the market

The Investor Lens: First-Mover Advantage or Trap?

Here’s where we get tactical. The Bayshore precinct is rolling out 10,000 total units: 7,000 HDB (including the HDB Plus “Bayshore Horizon” and “Bayshore Vista”) and 3,000 private. Vela Bay is 1 of only 3 private developments planned.

The Bull Case:

- You’re the first private option in a sea of HDB tenants (rental demand spillover)

- The TEL Golden Mile is just getting started: property within 400m of new MRT stations see 15-20% capital appreciation in the first 5 years (URA historical data)

- Projected 4-7% annual capital appreciation over the next 5 years (analyst consensus)

- The Linear Park and waterfront promenade will be fully completed by 2028: lifestyle upgrade locked in

The Bear Case:

- Early research suggests first-movers in new estates may see limited upside in 2026: the market’s still pricing in the 13,000 MOP flat supply shock

- You’re paying peak land cost pricing; the next 2 launches might undercut you by $100-200 PSF if demand softens

- 99-year leasehold vs. freehold Marina Bay Residences (comparable pricing, better tenure)

Vela Bay Investment Scorecard

| Criteria | Score (1-10) | Notes |

|---|---|---|

| Location (MRT Access) | 9.5 | 1-min walk to Bayshore MRT = A+ connectivity |

| Schools (Family Appeal) | 8.0 | Temasek Primary within 1km, solid JC options nearby |

| Project Size (Liquidity) | 9.0 | 515 units = high transaction volume, lower MCST fees |

| Pricing | 6.5 | $2,5xx PSF is steep; 25-30% premium vs. resale comps |

| Rental Yield Potential | 7.5 | Built-in tenant base from 7,000 HDB households, but yield ~3.0-3.5% |

| Capital Appreciation | 7.0 | 4-7% projected annual growth; TEL proximity adds 15-20% over 5 years |

| First-Mover Risk | 6.0 | Early buyers may face competition from 2 upcoming launches in 2027-2028 |

| Overall Investment Grade | 7.5/10 | Solid fundamentals, but timing and pricing need careful consideration |

The Verdict: Who Should Buy Vela Bay?

For Homeowners:

If you’re upgrading from an East Coast HDB and want the full condo lifestyle package (sea views, modern finishes, car-lite living), Vela Bay checks every box. The beamless interiors and smart home integration alone justify the premium if you’re living there for 10+ years.

For Investors:

This is where it gets tricky. The fundamentals are strong: MRT access, 515-unit liquidity, built-in rental demand. But you’re paying first-mover pricing in a market where 13,000 MOP flats are suppressing rents across the board. If you’re banking on 4-7% annual appreciation, make sure your holding period is 5+ years minimum. The real upside kicks in when the Linear Park completes, the commercial hub opens, and the Bayshore precinct fully matures (2028-2030).

Bottom line? Vela Bay is definitely a top contender if you’re committed to the East Coast story. Just don’t expect overnight gains. This is a medium-term play, not a flip-in-3-years lottery ticket.

Final Thoughts: The Bayshore Bet

When you strip away the marketing brochures and yacht-club aesthetics, Vela Bay is a calculated bet on the Bayshore precinct transformation. You’re buying into Singapore’s largest new housing estate in decades, with MRT connectivity that didn’t exist 3 years ago.

Is it overpriced? Maybe by $100-200 PSF. Is it a bad investment? Not if you’re playing the long game.

If you’re still on the fence, remember this: first-mover advantage only works if you’re early to a genuine transformation story. Bayshore has the infrastructure, the government backing, and the scarcity (only 3,000 private units). The question isn’t whether Bayshore will succeed: it’s whether you’re willing to pay the premium to be first.

—

Need help settling into your new Vela Bay home? Check out trusted home services providers on NearMe.SG: from interior designers to aircon servicing in District 16. Because moving into a $2.5M condo means you’re definitely not carrying your own furniture up 30 floors.

RELATED POSTS

View all