Otto Place Executive Condominium EC: 2025 Ultimate Free Guide

June 15, 2025 | by nearme.sg

Overview of Otto Place EC (Developer, Location & Launch Timeline)

Otto Place EC is an upcoming Executive Condominium (EC) located at Plantation Close in the heart of Tengah New Town, Singapore’s newest “forest town.” Developed by a joint venture of Hoi Hup Realty and Sunway Developments, Otto Place will offer around 600 residential units across 7-8 blocks. This is the developers’ second EC in the vicinity (Parcel A, now called Novo Place, was their first), reflecting their confidence in Tengah’s growth potential.

Located just minutes from two future Jurong Region Line (JRL) MRT stations – Tengah Park and Bukit Batok West – the site boasts excellent connectivity. In fact, Tengah Park MRT station (expected to open by 2028) will be within a short walk of the development. For drivers, the location is equally convenient: by 2027 a new road will link Plantation Close directly to the Pan Island Expressway (PIE), and major expressways like KJE and BKE are also easily accessible. Being in District 24 (Choa Chu Kang/Tengah), Otto Place is near the Jurong region, including the up-and-coming Jurong Lake District (JLD) – slated to be Singapore’s largest mixed-use business district outside the city center.

Launch Timeline: The Otto Place EC showflat is slated to open for preview from 4th to 15th July 2025, with the booking (launch) day on 19th July 2025. This makes Otto Place one of the anticipated executive condo launches of 2025, and notably, possibly the last EC launch in the western region for the next few years (given limited EC land supply in the West). The project’s expected completion (TOP) is around Q1 2028, so buyers can plan to move in roughly 3 years from launch. As an EC, Otto Place will have the standard 99-year leasehold tenure and will be sold under HDB’s EC eligibility rules (more on that later).

Developer Background: Hoi Hup Realty and Sunway Developments are experienced in residential projects, with a strong EC track record. They previously developed Parc Canberra EC (496 units) and Parc Central Residences EC (700 units), both fully sold successes. Their ability to plan and sell two adjacent Tengah EC sites (Novo Place and Otto Place) also speaks to their long-term commitment in Tengah. Hoi Hup’s chairman has expressed a vision of “high-quality ECs leveraging accessibility to new amenities in Tengah and the nearby Jurong Lake District”, aligning Otto Place with Singapore’s smart and sustainable town initiatives.

Unit Mix, Pricing, and Facilities at Otto Place EC

Otto Place EC is tailored for family-oriented living, as evident from its unit mix. It will offer only 3-bedroom and 4-bedroom apartments, with no 1- or 2-bedroom units. This signals a focus on HDB upgraders and family buyers who need more space. The unit types are expected to range from compact 3-bedders around ~872 sq ft, up to spacious 4-bedder layouts near ~1,195 sq ft. Below is a summary of the unit mix and indicative sizes:

| Unit Type | Size Range (sq ft) | No. of Units | Indicative Starting Price |

|---|---|---|---|

| 3 Bedroom (various layouts) | ~872 – 958 sq ft | ~369 units | From ~S$1.33M (est. S$1,350 psf) |

| 4 Bedroom (various layouts) | ~1,012 – 1,195 sq ft | ~231 units | From ~S$1.58M (est. S$1,550 psf) |

Table: Otto Place EC unit mix, sizes, and estimated starting prices. (Prices are tentative estimates based on recent EC launches)

Similarly, Altura EC in Bukit Batok (launched 2023) hit an average of ~S$1,433 psf on launch. We can expect Otto Place EC’s pricing to be in the mid-$1,400s psf on average, meaning entry prices likely around mid-$1.3xx million for smaller 3BR units and upwards of $1.7M for the largest 4BRs. Of course, final prices will depend on floor level, orientation, and other attributes when the price list is revealed during launch.

In terms of facilities, Otto Place EC will provide a full suite of condo amenities, comparable to private condominiums. Residents can enjoy a 50m lap pool, family pool and kids’ water play zone, a spacious clubhouse, indoor gym, and function rooms for gatherings. Outdoor facilities are set to include BBQ pits for cookouts and a tennis court – a luxury that not all condos have, underlining the generous land area at Otto Place. Lush landscaping and gardens will be part of the design, consistent with Tengah’s green town theme. The project will have a basement carpark and a landscaped deck above with these communal facilities, ensuring the grounds are car-lite and safe for residents to stroll. Additionally, smart home features and eco-friendly touches (energy-efficient appliances, smart lighting, etc.) are expected, as the developers emphasize “smart & sustainable living” with future-proof infrastructure. In short, Otto Place EC promises full condo living – you’ll get the same kind of facilities and security as a private condominium, at a more attractive price point.

Location and Connectivity: Tengah’s Forest Town Advantages

Artist’s impression of Tengah’s planned car-free town centre and green spaces. Tengah is Singapore’s first “Forest Town,” emphasizing sustainability and smart living.

One of Otto Place EC’s biggest draws is its location in Tengah, Singapore’s first new HDB town in over 20 years. Tengah is often dubbed the “Forest Town” for its abundant greenery and innovative planning. The town is being developed with a strong focus on sustainability, green spaces, and smart technology. For example, Tengah will feature a car-free town center, with vehicular roads running beneath the town centre to create a pedestrian-friendly surface level. There will be dedicated cycling and walking networks, a central park with a “forest stream,” and community farms, all fostering a green, tranquil living environment. For Otto Place residents, this means a unique opportunity to live in a modern estate that integrates nature with urban comforts. You can expect cleaner air, park views, and eco-friendly initiatives (solar panels, regenerative lifts, smart lighting in common areas, etc.) as part of everyday life.

Connectivity: Despite the tranquil setting, Otto Place EC is extremely well-connected. The development lies adjacent to the Jurong Region Line (JRL) route, with Tengah Park MRT station just a few minutes’ walk away. Another station, Bukit Batok West MRT, is also within walking distance (approximately 5 minutes), giving residents multiple options once the JRL opens. The JRL, slated to open in phases from 2027 through 2029, will link western Singapore comprehensively. From Tengah Park station, residents can ride directly to key hubs like Jurong Innovation District (JID) (an emerging employment and tech hub), the Jurong Lake District (second CBD), Nanyang Technological University, Jurong East interchange, and even out to Choa Chu Kang and northern areas. In practical terms, a future trip from Tengah to Jurong East MRT (where there’s interchange to North-South and East-West Lines) will be much shorter and entirely MRT-accessible. This enhanced public transport will greatly benefit those working in Jurong, Tuas, NTU or even town – making the car-free vision of Tengah quite achievable.

For those who drive, the location is equally strategic. Plantation Close will connect directly to the PIE by 2027, meaning you can hop on the expressway in minutes and reach other parts of the island conveniently. The Kranji Expressway (KJE) is nearby too, which links to the Bukit Timah Expressway (BKE) towards Woodlands/Bukit Panjang. Key destinations like Jurong Lake District (future CBD) and Tuas Port are a short drive westwards, while towns like Choa Chu Kang and Bukit Batok are just next door. Despite being a new township, Tengah’s accessibility is rapidly coming on par with established estates, thanks to these infrastructure investments.

Map of the new Jurong Region MRT Line (JRL) which will serve Tengah. Otto Place EC residents will be walking distance to Tengah Park station on this line, providing direct connections to Jurong Lake District, Choa Chu Kang, and more.

Amenities and Shopping: While Tengah is still in development, there are several amenities either existing or in the pipeline:

- Nearby Malls: Just a 5-10 minute drive away in Jurong East are major shopping malls like JEM, Westgate, IMM, and JCube. These offer comprehensive retail, dining, grocery, and entertainment options (from supermarkets to cinemas). Closer by, residents can also visit Le Quest Mall (Bukit Batok), which has a FairPrice Finest supermarket, food court and shops, or the future Tengah town centre which will host retail and a market & hawker center. In fact, Otto Place will be near the upcoming Tengah Boulevard Bus Interchange and town center, so eventually residents can enjoy new neighborhood shops, a polyclinic, community club and more within Tengah itself.

- Recreation: Nature lovers will enjoy the many parks planned in Tengah. Central Park (a large 20-hectare park with water features) will be a highlight, alongside smaller community parks and linear green corridors. For sports and recreation, the Jurong Lake Gardens and Bukit Batok Town Park (Little Guilin) are a short drive away. Tengah will also have its own sports complex and polyclinic in future plans.

- Schools: Otto Place is ideal for families with school-going children. A number of primary schools will serve the area – Princess Elizabeth Primary, Jurong Primary, Pioneer Primary, among others, are within a 1-2km radius. Notably, Anglo-Chinese School (Primary) is relocating to Tengah by 2030/2031, and its new campus will be within 2km of Otto Place. This has already generated excitement among parents, given ACS’s prestigious brand. Within 1km, there will also be a new primary school opening by 2028 to serve Tengah’s growing population. For secondary education, Bukit Batok Secondary, Jurongville Secondary, Crest Secondary, Hillgrove Secondary are all in the wider vicinity. In summary, families at Otto Place will have a wide selection of schools nearby – from new neighborhood schools to established ones – which is a significant plus for long-term home value and convenience.

- Future Developments: Tengah’s growth will continue even after Otto Place is built. The URA Master Plan includes plans for a business park in Tengah, more community and commercial facilities, and enhanced connectivity to Jurong. The proximity to Jurong Innovation District means future high-tech jobs could be close to home. All these bode well for capital values in Tengah – early residents could reap the benefits of an entire new town maturing around them in the coming decade.

How Does Otto Place Compare to Other EC Launches?

With several ECs launched in the west in recent years, how does Otto Place EC stack up? Let’s compare it to a few recent examples:

- Copen Grand (Tengah) – Launched in late 2022 as the first EC in Tengah, Copen Grand sold out quickly, indicating strong demand for ECs in a brand new town. It introduced buyers to Tengah’s potential. Otto Place, being the second/third EC in Tengah (Novo Place launched slightly earlier), benefits from Tengah’s increasing familiarity. Unlike Copen Grand which had 2BR units, Otto Place focuses on larger units, targeting mainly upgraders.

- Altura EC (Bukit Batok West) – Launched August 2023, Altura was the only EC launch of 2023 and saw 61% of units sold on day one. It eventually sold all 360 units by mid-2025. Altura’s success (at ~$1,433 psf average price) set a record at the time, showing that buyers were willing to pay more for ECs in good locations. Altura is located a bit closer to the existing Bukit Batok estate and right next to a future JRL station as well. In comparison, Otto Place’s price per square foot will likely be slightly higher given market trends (possibly mid-$1.4k psf vs Altura’s low-$1.4k), but it also offers the novelty of Tengah’s greener environment. Both are in the western region, but Otto Place might be seen as a more futuristic township setting versus Altura’s mature-town proximity.

- Lumina Grand EC (Bukit Batok West) – This EC launched in 2024 (the first EC of 2024) and sold 53% of its 512 units on launch weekend at an average of about $1,464 psf. Lumina Grand’s developer (CDL) capitalized on its location near Bukit Batok and the upcoming ACS Primary campus. Interestingly, Lumina Grand included some 5-bedroom units, attracting larger families. Otto Place does not have 5BR units, focusing on 3 and 4BR, which suggests it targets a slightly more mid-sized family demographic. Price-wise, Otto may be similar or a touch higher due to timing (mid-2025 launch). However, Otto Place’s edge is that it’s right inside the Tengah masterplan (Lumina is at Bukit Batok West, at the fringe of Tengah). Otto’s immediate surroundings will evolve dramatically (new town centre, parks, etc.), which could give it an appreciation upside as the town matures.

- Novo Place EC (Tengah) – Otto Place’s “sister project” next door (Parcel A) actually launched in late 2024. Novo Place had 504 units and a similar unit mix of 3 and 4 bedrooms. If you’re comparing Novo vs Otto: both share the same strategic location benefits in Tengah; the main differences might come down to design, orientation, or minor layout tweaks. Novo Place’s launch in Nov 2024 reportedly saw positive response, but as it launched amid cooling measures, some buyers held back. By mid-2025, with demand accumulating (and if interest rates stabilize), Otto Place could see very strong uptake. Market positioning-wise, Otto Place, being one of the last ECs in the pipeline for the West region, may command slightly more attention from upgraders who missed earlier projects.

In summary, Otto Place EC is positioned competitively: it offers a fresh opportunity for those who value being in a new growth town (Tengah) as opposed to an established town. Buyers who prioritize immediate surrounding amenities might lean towards an EC like Lumina Grand (in a developed area), but those with a bit of patience and an eye on future potential will appreciate Tengah’s upside with Otto Place. Moreover, after Otto and Novo, there’s a notable gap in the EC supply for western Singapore, which could mean pent-up demand and resale scarcity in a few years. Being an early mover in Tengah by buying Otto Place could potentially yield a bigger capital upside compared to later entrants, especially once the JRL is running and ACS (Primary) is up and the whole area is more vibrant.

HDB Upgraders: Pros, Cons, and Financial Planning

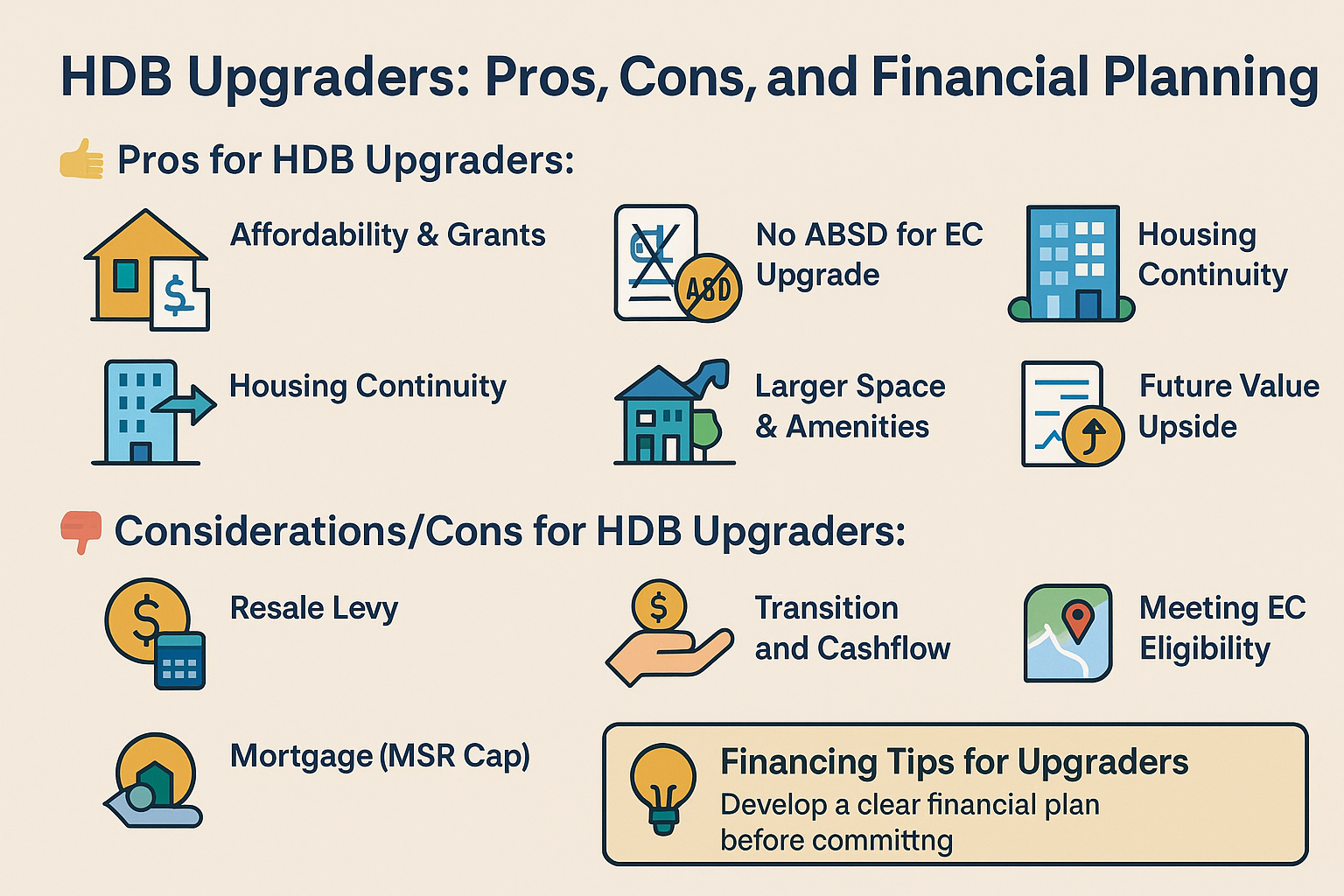

One key target audience for Otto Place EC is HDB upgraders – families currently in HDB flats (often 4- or 5-room) looking to upgrade to their first private property. Executive Condos were designed with this group in mind, providing an affordable pathway to private condo living (after the 5-year MOP) while still enjoying certain subsidies at purchase. Here’s what HDB upgraders need to know:

👍 Pros for HDB Upgraders:

- Affordability & Grants: New ECs are priced more affordably than comparable private condos. Upgraders buying Otto Place still benefit from housing subsidies – e.g. if you’re a first-timer upgrader (never taken a housing grant before), you could qualify for the CPF Housing Grant of up to $30,000 when buying an EC. This directly reduces the purchase price. Even second-timers (who previously bought BTO direct) are drawn to ECs because the price gap between selling your HDB and buying the EC is more manageable than jumping straight to a full private condo.

- No ABSD for EC Upgrade: A huge financial relief – HDB upgraders do NOT need to pay Additional Buyer’s Stamp Duty (ABSD) when buying a new EC, as long as one buyer is a Singapore Citizen. EC purchases by SCs get upfront ABSD remission, meaning you can purchase Otto Place while still owning your HDB and not incur the hefty 17% ABSD that you would face if you bought a private condo without selling your flat first. This is a key advantage unique to ECs (ABSD is fully waived for new ECs). It allows you to secure your EC unit first, then dispose of your HDB later, with less pressure.

- Housing Continuity: Related to the above, because you can hold your HDB until the EC is ready, you ensure continuous housing. There’s no need to rent during construction if finances allow you to hold both temporarily. HDB rules simply require that you sell off the HDB within 6 months of getting your EC’s keys. This makes upgrading smoother – you can plan the handover such that you move from your flat into the brand-new Otto Place with minimal interim downtime.

- Larger Space & Amenities: Many HDB upgraders will find Otto Place’s 3 and 4-bedroom units appealing because they often provide more efficient layouts and modern design than older resale flats. You’ll also gain condo facilities (pool, gym, security) that HDB living doesn’t offer. It’s a lifestyle upgrade for the family – weekends by the pool, a private gym downstairs, function rooms for parties, etc., all within a gated community. For families coming from older estates, Tengah’s abundance of green parks and new schools is also a plus.

- Future Value Upside: Upgraders typically plan long-term. Buying into Otto Place in a developing town means you could see significant appreciation by the time you fulfill the 5-year Minimum Occupation Period. Many past HDB upgrader stories involve selling their EC after MOP for a substantial profit (more on capital appreciation in the Investor section). This could be a stepping stone – e.g. upgrade from HDB to EC now, then 5-10 years later potentially upgrade again to a larger private condo or landed property using the gains.

👎 Considerations/Cons for HDB Upgraders:

- Resale Levy: If you are upgrading from an HDB that you bought directly from HDB (BTO or SBF) or from another EC you bought new, note that HDB will impose a resale levy when you buy a new EC. The levy ranges (e.g. $55k for a 4-room, $40k for a 3-room, etc.) depending on your first subsidized housing type. This levy essentially reduces your sale proceeds from the HDB, which is a cost to factor in. First-timers upgrading from a pure resale HDB (with no grant taken) won’t have a levy, however.

- Mortgage (MSR Cap): Financing an EC is subject to stricter rules than a private condo. Banks will evaluate your loan under the Mortgage Servicing Ratio (MSR) framework – only up to **30% of your gross income can go towards the EC housing loan. This is tighter than the 55% Total Debt Servicing Ratio for private properties. In practical terms, you may not be able to borrow the full 75% loan if 30% of your combined income doesn’t support it. Upgraders should crunch numbers carefully: depending on your income, you might need a larger downpayment (or to use cash/CPF from your HDB sale proceeds to reduce the loan). The good news is that progressive payment for ECs means the mortgage payments start small during construction, giving you time to adjust finances.

- Transition and Cashflow: While you can keep the HDB until the EC is ready, it means your CPF is tied up in the HDB until you sell it. Some buyers sell their HDB first to free up CPF for the EC downpayment – but then they need interim housing. Others use bridging loans or cash savings for the EC downpayment and only sell the flat closer to EC completion. This requires careful financial planning (e.g. ensuring you have the 5% option fee in cash, plus another 15% downpayment which can be CPF – note that CPF used will be refunded from your eventual HDB sale). Also, during the overlap you’ll service two loans (HDB and the small progressive EC loan tranches). As long as you budget for it, it’s manageable, but it’s a commitment.

- Location Trade-offs: Many HDB upgraders currently live in more mature estates (Jurong, Bukit Batok, Choa Chu Kang, etc). Moving into Tengah means embracing a new town that’s still developing. For the first few years, certain amenities might be limited compared to an established town – e.g. fewer shops or eateries within walking distance until the town centre is up. Some upgraders might miss the hustle and bustle of a mature neighborhood market or the familiarity of an old community. That said, Jurong is very close by for “big town” conveniences, and as described, many facilities are on the way in Tengah. It’s a short-term trade-off for long-term gain.

- Meeting EC Eligibility: As an HDB upgrader, you must ensure you meet EC criteria: mainly, you’ll need to form a family nucleus (which you have if you own an HDB as a family), and your household income must be ≤ $16,000 at the point of application. If your income has grown above that, unfortunately you can’t buy a new EC and might have to consider resale EC or private condo instead. Also, you cannot own any other property while booking the EC (aside from your HDB which is okay). If you own, say, a small overseas property or inherited one, you’d need to dispose of that to qualify.

Financing Tips for Upgraders: The biggest tip is to get a clear financial plan before committing. Work out your current HDB’s sale potential (many upgraders use their flat’s sale proceeds to fund the EC purchase). Check your MSR loan limit with the bank early (you can get an Approval-in-Principle). Also remember you’ll need 5% cash for booking – plan where that will come from (savings, or sale of some investments, etc.). Since ABSD isn’t an issue for EC, leverage that by timing your flat sale optimally (you might sell just after you secure your EC unit or even wait until just before EC completion if the market is still rising). Lastly, note the resale levy will be deducted from your flat sale’s CPF proceeds when you buy the EC – be aware of how much that is, so it doesn’t surprise you at completion.

Bottom Line: For HDB upgraders, Otto Place EC represents a chance to move into private-style living at a palatable price, with minimal downtime between homes and significant future upside. The key is to enter with a solid financial strategy and an understanding that Tengah’s full potential will unfold over the next few years. If you’ve been sitting on significant HDB paper gains (many upgraders are selling flats at record prices today), plowing that into an EC like Otto Place can be a smart way to level-up your housing and investment in one move.

First-Time Private Property Buyers: Opportunities and Considerations

Another important group is first-time buyers who have never owned private property (and perhaps are currently renting, living with family, or in an HDB but now income-eligible to upgrade). This includes young couples buying their first home, or even single Singaporeans aged 35 and above who can team up under the Joint Singles Scheme for EC. For these buyers, Otto Place EC offers a unique entry point into the private property market.

👍 Pros for First-Timers:

- CPF Grants and No Resale Levy: As true first-timers (no prior subsidized housing), you enjoy the full CPF Housing Grant (up to $30,000) for ECs. This is essentially “free” money towards your home, something not available if you were buying a private condo. It makes the effective price of your Otto Place unit even lower. And since you have no previous HDB, there’s no resale levy or other penalty – you start with a clean slate of benefits.

- Lower Upfront Cash Requirement: ECs only require a minimum 5% downpayment in cash (same as private), but because of the progressive payment scheme, you don’t have to pay the full downpayment or start full loan repayments until the project is built. This is great for first-timers who might be early in their careers – you can secure a home now with relatively little cash, then save and grow your income over the next 3 years while the EC is being constructed. By the time the heavier payments kick in, you might be in a stronger financial position. In contrast, buying a resale flat or resale condo would require immediate full payment or a much bigger cash outlay at once.

- Private Condo Lifestyle at Lower Price: As a first home, getting a condo with facilities is a huge perk. Otto Place EC lets you enjoy a new condo with pools, gym, and smart features at a price often 20-30% cheaper than a similar new private condo. For example, new mass-market condos today often sell above $1,900–$2,000 psf in many areas, whereas Otto Place is expected around $1,4xx psf. For first-timers on a budget, ECs are the best value – you sacrifice a few years of rental ability (the MOP period) in exchange for a much lower entry price.

- Tengah’s Future for Young Families: Many first-time buyers are young couples planning to start families. Tengah offers a forward-looking environment to raise kids – plenty of green spaces, upcoming childcare centers, and safe community design (car-lite town, cycling paths). By the time your kids are older, the town will have even more amenities like playgrounds, a community club, and perhaps even its own mall. It’s like getting in on the ground floor of a future vibrant town, which is exciting for those who want to be pioneers in a new community.

- No Need to Compete in HDB BTO Ballots: Some first-timers consider BTO flats, but in popular areas those can be hard to get and also have a wait of 4-5 years. Otto Place EC, while a bit more expensive than BTO, guarantees you a unit (as long as you book on launch successfully) and you get a condo-quality home. Plus, the wait is similar ~3 years. For those who can afford the roughly $1.3M price, skipping the BTO race and going for an EC can be very rewarding. After 5 years of living there (MOP), it’s a private condo you fully own without any subsidy clawbacks.

👎 Considerations/Cons for First-Timers:

- Income Ceiling and Loan Restrictions: The first big hurdle – you must have household income ≤ $16k/month to qualify to purchase an EC. If you and your partner are doing well and exceed this, you’ll have to consider private condos instead. Assuming you qualify, remember the MSR 30% rule will cap your loan. For example, at $12k income, max housing loan allowed is $3.6k/month repayment (30%), which roughly translates to around a ~$900k loan (depending on tenure/rates). If your EC unit is $1.4M, you’d need ~$500k downpayment (which is ~35%). Many first-timers won’t have that much cash/CPF saved yet. In reality, to afford a ~$1.4M EC under MSR, combined income often needs to be closer to $14k-$16k (to borrow ~1.0M+) or you need significant CPF savings for downpayment. So, some first-timers may find ECs financially stretching at current price levels. It’s important to do an affordability check (99.co and others have MSR calculators). The silver lining: if you do qualify, banks can lend up to 75% and interest rates for home loans are currently moderate, making it a stable leverage to take on.

- Construction Wait: If you’re currently renting or living with parents, remember you’ll have to wait ~3 years for Otto Place to be ready. During this time, you might continue renting (an extra cost) or staying with family (which can be a pro or con!). Unlike buying a resale flat you move into immediately, EC requires patience. Make sure your living arrangements for 2025-2028 are sorted out. Some young couples are fine staying with parents a bit longer to save money until the EC is done, but for others eager to move out, this wait can be frustrating. It’s a personal situation assessment.

- MOP and Restrictions: After getting your keys, note that you must fulfill a 5-year Minimum Occupation Period where you owner-occupy the EC and cannot sell or rent out the entire unit. (You can rent out rooms if you live there, but not the whole unit.) For genuine owner-occupiers this is usually fine – five years flies by. But just be aware: if for some reason your plans change (say you get an overseas job posting, or decide to upgrade again quickly), you’re basically tied to not being able to dispose of the property or lease it out fully in that period. Compare this to buying a private condo: you could rent or sell anytime. So ensure you’re ready to commit to living in Otto Place for at least 5-6 years once it’s done (3 years construction + 5 years MOP). For most first-timers starting a family or new job, that’s okay.

- Future Payment Burden: As a first-time buyer, this might be your first experience with a large mortgage. Keep in mind that while progressive payments are light at first, by TOP you’ll likely start paying the full monthly installment. Ensure that your income growth prospects, job stability, and emergency funds are sound. Also consider that ECs, like all homes, come with recurring costs: monthly maintenance fees (estimate perhaps $300+ for Otto Place given full facilities), property tax (once privatized), etc. Budget these in so you’re not caught off guard. It’s wise not to max out your MSR 30% entirely – leave some buffer for interest rate increases or life changes (kids, etc.).

- Alternate Options: It’s worth comparing your options: with a $1.3M budget, you could also consider a resale EC or older resale condo in another town. Sometimes first-timers overlook the resale market, but a slightly older condo might offer immediate occupation and no MOP. However, you’d miss out on grants and the lower EC entry price. Still, do your homework – for instance, a 5-year-old EC in Sengkang might cost similar but you can move in right away and even rent out. Decide what matters: a brand-new home with subsidies (EC) vs. immediate flexibility (resale private). Many will still choose Otto Place EC for the brand new factor and growth story, but it’s a thought process to go through.

Why Otto Place EC is Attractive for First-Timers: In a nutshell, it offers the chance to own a private condominium as your very first home, something that in Singapore is quite special. You’re effectively “jumping the queue” by getting a condo at a subsidized price. Long-term, this can accelerate your wealth building – by the time it’s fully private (10 years from launch), you might see substantial appreciation. The government’s intention is to help you, as a first-timer, move up the housing ladder with ECs, so take advantage of the grants and no-ABSD benefits. Just enter prudently, choose a unit size that fits your budget (3-bedrooms at Otto Place vary in size/cost, you don’t necessarily need the biggest unit as your first home). Also, consider using features like the deferred payment scheme if offered (sometimes developers allow deferred downpayment until TOP for EC – to be confirmed for Otto Place) or plan to pay more when you have CPF accruals. All these can ease your journey.

By planning ahead for the financial commitment and being mindful of the initial restrictions, first-time buyers can find Otto Place EC to be an ideal starter home that combines homeownership with investment potential.

Property Investors: Rental Yield & Capital Appreciation Potential

Typically, pure “property investors” (in the sense of buying to rent out immediately) can’t directly purchase a brand-new EC due to eligibility rules. However, many savvy buyers — including some HDB upgraders and first-timers — treat an EC purchase as an investment for the medium to long term. The idea is: live in it for 5 years, then either rent it out or sell for profit once it’s fully privatized. In this context, we’ll address Otto Place EC from an investor’s perspective: what is the rental yield and capital appreciation outlook, and what are the pros/cons of choosing an EC as an investment vehicle.

Capital Appreciation Potential: Historically, ECs have shown strong capital gains by the time they meet MOP and even more when they become fully privatized (at 10 years). Developers and analysts often cite that EC buyers enjoy a “second bite of the cherry,” meaning you profit first from any normal market rise over 5 years, and second from the “upgrading” of the property’s status from quasi-public to fully private at the 10-year mark. According to market data, many EC projects appreciate significantly – for instance, owners at Bellewoods EC (Woodlands) and Sol Acres EC (Choa Chu Kang) saw price increases of about 45-50% from launch to post-MOP resale, translating to several hundred thousand dollars in gain per unit. In fact, some were “sitting on $220k to $500k capital gain” by the 5-year mark. This trend is common: numerous ECs that launched around $700-$800k a decade ago are now selling at $1.2M-$1.3M or more after turning fully private.

For Otto Place EC, the investment narrative is compelling:

- You are buying at a relative discount to surrounding private condos. By the time Otto Place hits MOP (around 2030), Tengah will have many more amenities, and there could be private condo launches nearby (perhaps on GLS sites in Jurong or elsewhere) likely selling for much higher psf. Your cost base is lower, so the upside margin is high. Once the initial EC restrictions lift, the unit can be sold to a broader buyer pool (PRs at 5-year, foreigners at 10-year), potentially narrowing the price gap with pure private condos.

- The upcoming infrastructure (JRL fully operational by 2029, Jurong Innovation District, Jurong Lake District developments) will create more demand in this area. If Jurong Lake District blossoms into a major commercial hub by 2030, housing nearby (including Tengah) should see values climb. Early adopters at Otto Place could benefit from this macro trend.

- Even the developers highlight ECs as a strong investment: marketing for Otto Place points out ECs’ “historically high capital appreciation after 5-year MOP”. Of course, past performance isn’t guaranteed, but given the limited EC supply and Singapore’s housing trajectory, it’s reasonable to expect solid appreciation. Being among the first condos in Tengah also means there’s a novelty and first-mover advantage.

Let’s put rough numbers: If Otto Place sells at ~$1,450 psf now, and if nearby fully private condos in 5-6 years are transacting at $1,800 psf (not unrealistic in a bullish scenario, considering some OCR condos already hit $1,7k+ psf in 2023-2024), then post-MOP Otto Place might trade closer to that range, giving original buyers a hefty return. Even conservative estimates of 2-3% annual growth could mean ~15% rise in 5 years. Some ECs have jumped 30%+ in value immediately after MOP due to pent-up demand from buyers who prefer a “nearly-new” condo without waiting for construction.

Rental Yield Potential: Once the 5-year MOP is over, owners can rent out the entire unit freely. ECs often enjoy good rental demand because by then they are relatively new condos with full facilities, but offered at rents sometimes slightly cheaper than brand-new condos (which makes them attractive to tenants). For investors, since you bought at a lower price, your rental yield on cost can be quite healthy. For example, say a 3-bedroom at Otto Place is bought for $1.3M in 2025. Come 2030, if the rental market is strong, a 3-bed might rent for, hypothetically, $4,000–$4,500/month (just an estimate based on current Jurong 3-bed rents). That’s about 3.5% annual yield on your original price, which is decent by Singapore standards (many new condos yield ~2-3%). If you factor that you only put 25% down and the rest is loan, the cash-on-cash returns amplify. Additionally, Tengah’s proximity to Jurong job centers means a large tenant pool: expats or local families working in Jurong Innovation District, international school staff, etc., might be looking to rent in a modern condo nearby. Another plus: ACS (Primary) in Tengah could drive some expat families to rent in the area for school placement.

Exit Strategy and Liquidity: Investors should consider that while ECs are great for appreciation, they are not liquid in the short term. You’re essentially locked in for 5 years minimum. If you foresee needing to cash out before that, an EC is not suitable. But if your horizon is medium-term, it’s fine. By year 5, many EC owners do cash out. In fact, data shows a large proportion of EC units get sold soon after the MOP year, as owners take profit or upgrade again. Liquidity at that point is usually high – there’s often a queue of resale buyers waiting for ECs to hit MOP because they tend to be more affordable than new condos. So, selling after 5 years is generally not an issue (unless the market is in a deep slump). If you hold till the 10th year (when Otto Place becomes fully privatised around 2035), you can sell to an even wider audience (including foreigners, investment companies). That typically further boosts demand and sometimes commands a price jump especially if foreign buyers find value relative to prime areas.

Comparing to Other Investments: Some prospective investors might wonder, why not just buy a private condo unit for rental immediately? The truth is, if you’re eligible for an EC, the return on investment for EC can be superior because of the initial discount and grant. It’s a bit like getting in at “developer cost” and then riding the value uplift. The catch is the time you must hold and the fact that you must actually occupy it (so if you don’t actually need housing, that’s a consideration). But many investor-minded buyers will live in the EC just to fulfill MOP, all the while planning their next move. A common strategy: a couple buys an EC, lives in it 5-6 years, sells for profit, then with that larger capital, upgrades to a landed or a centrally located condo. It’s a proven path for asset progression in Singapore’s context (sometimes termed “EC laddering”).

Risks/Cons for Investors:

- Market risk: Property values can fluctuate. If there’s a major downturn or policy changes (e.g., further cooling measures on selling or buying), it could affect resale values. ECs are still subject to market forces. However, the downside risk for ECs is somewhat mitigated by the initial lower price – you have a buffer compared to someone who bought a private condo at full price.

- Rental timing: If you plan to rent out after MOP, remember Tengah will have multiple ECs maturing around similar time (Copen Grand’s MOP ~2029, Novo Place ~2032). There could be a surge of similar units hitting the rental market together. If supply is high, rents might be competitive initially. Over the long term, as the area fully develops, rental demand should stabilize, but be prepared that first rental yields might not skyrocket if many owners try to lease out at once. That said, Jurong’s growth might also mean more tenant demand.

- Opportunity cost: Tying up your funds in an EC means you cannot invest in another property (since you can’t buy another property during EC MOP without incurring ABSD heavily). For some, that’s fine; for others who have high investment capacity, it might feel limiting. However, one workaround some do is “decoupling” later or one spouse names on EC and the other buys another property after MOP – but those are advanced moves requiring careful planning to avoid stamp duties.

Bottom Line for Investors: Otto Place EC offers a very compelling proposition for long-term wealth growth. If you view your home also as an investment (the typical Singaporean way), this EC allows you to have your cake and eat it – a quality home for your family and a likely profit generator in the future. The key is to enter at a price within your means, and be patient and strategic about your exit. Many EC owners have made $200k-$400k profits upon resale, which can significantly bolster your financial standing. While you enjoy living there, keep an eye on Tengah’s development and the broader market; plan whether you’ll sell right at MOP or hold longer for full privatisation. Either way, Otto Place should yield a positive return if Singapore’s property trajectory and past EC performance are any indication.

Lastly, for a pure investor who might not personally occupy (say you’re helping your children purchase an EC in their name as first-timers, with the idea of it being an investment for them), remember that the fundamentals of Otto Place are strong: good location, connectivity, and scarce future supply in the vicinity. These fundamentals drive both rental and resale value, making it a sound investment bet in 2025.

Pros and Cons Summary for Each Buyer Profile

To wrap up, here’s a quick summary of pros and cons of Otto Place EC tailored to the three audience segments:

- HDB Upgraders: Pros: No ABSD, can port over HDB to EC seamlessly, condo lifestyle upgrade, potential big appreciation to fund next upgrade. Cons: Must plan around resale levy and MSR 30% cap, interim cash flow juggling, moving to a less mature town initially.

- First-Time Buyers: Pros: Grants up to $30k, affordable entry to private condo, brand-new smart home, future growth town, no need to battle BTO queues. Cons: Income ceiling of $16k, construction wait, locked in by MOP, large financial commitment early in life.

- Investor-Minded: Pros: “Built-in discount” means high capital gain potential, can leverage EC as stepping stone, good future rental prospects with Jurong Region growth, limited competition after privatisation. Cons: Illiquid for first 5 years, cannot monetize or rent out during MOP, reliant on future market conditions, opportunity cost of other investments during holding period.

In all cases, Otto Place EC in Tengah stands out as a promising development, offering deep value now and exciting potential in the years ahead. By understanding your profile and priorities, you can make the most of what this executive condo has to offer.

RELATED POSTS

View all