Singapore Landed Homes Out of Reach Soon? Expert Views

January 18, 2026 | by nearme.sg

When it comes to the Singapore Dream, few things capture the imagination quite like owning a landed home. Picture this: your own terrace house with a little garden, space for the kids to run around, maybe even park two cars in your own driveway. For decades, this was the aspirational peak for hardworking Singaporean families: the ultimate sign that you’d “made it.”

But here’s the uncomfortable truth in 2026: for the vast majority of Singaporeans, landed property ownership has quietly shifted from “stretch goal” to “near impossibility.”

Let’s unpack exactly why: and what this means for you if you’re dreaming of upgrading beyond your HDB or condo.

The Landed Home Dream: A Brief History

Rewind 20 or 30 years, and the narrative was very different. Back in the 1990s and early 2000s, a hardworking dual-income family in Singapore could realistically aspire to a modest terrace house in the suburbs. Prices were high, sure, but not astronomically so. A freehold terrace in areas like Serangoon Gardens or Kovan might have cost $800,000 to $1.2 million: a stretch, but achievable for disciplined savers.

Fast forward to 2026, and the landscape has transformed beyond recognition. The same terrace house? Expect to pay $3.5 million to $5 million or more, depending on location, condition, and land size. In prime districts, even a modest semi-detached can easily exceed $8 million.

The question is: have Singaporean incomes kept pace?

The Numbers Don’t Lie: Price Growth vs Wage Growth

Here’s where things get sobering. Let’s talk numbers.

Over the past 15 years, landed property prices in Singapore have grown at an average of 6-8% per year: with some segments, like inter-terrace houses, outperforming even the overall private property price index by around 4% in recent years alone.

Meanwhile, median household income growth in Singapore has hovered around 3-4% annually. For individual wages, the picture is often even more modest, especially for those in the middle-income bracket.

What does this mean in real terms?

- In 2010, the median household income was approximately $7,000/month. A $1.5 million terrace represented roughly 18 years of gross household income.

- In 2026, median household income sits at around $11,500/month. But that same terrace now costs $4 million: equivalent to 29 years of gross household income.

The gap has widened dramatically. Landed homes haven’t just appreciated: they’ve accelerated away from the earning power of ordinary Singaporeans.

Why Is Land So Scarce (And So Expensive)?

Singapore is, quite simply, one of the most land-constrained countries in the world. At just 733 square kilometres, there’s only so much physical space to go around: and the government has to balance residential land with commercial, industrial, and green space needs.

Here’s what’s driving the landed property crunch:

1. Extremely Limited Land Supply

Landed homes occupy a disproportionately large amount of land per household. While high-rise condos and HDB flats can house hundreds of families per hectare, a landed estate might only accommodate a dozen. The math simply doesn’t work for a dense city-state.

2. Zoning Restrictions

The Urban Redevelopment Authority (URA) tightly controls where landed homes can be built. Large swathes of Singapore are zoned exclusively for high-rise development, and new landed estates are almost never approved. What exists is essentially all there will ever be.

3. Foreigner Ownership Restrictions

Unlike condos, landed homes in Singapore are largely restricted to Singapore citizens (with some exceptions for PRs in certain areas like Sentosa Cove). While this protects local ownership, it also concentrates demand among a limited buyer pool: mostly wealthy Singaporean families and investors.

4. Property Taxes and Cooling Measures

Additional Buyer’s Stamp Duty (ABSD) and other cooling measures have made it expensive to own multiple properties. But for landed homes, the base prices are so high that these measures barely dent demand among the ultra-wealthy: they simply price out everyone else.

The Growing Divide: Landed vs Condo vs HDB

Let’s put this into perspective. In 2026:

| Property Type | Median Price (Central/Suburban) | Price Growth (10-Year Avg) |

|---|---|---|

| 4-Room HDB Resale | $550,000 – $650,000 | ~4% p.a. |

| Mass-Market Condo | $1.2 million – $1.8 million | ~5% p.a. |

| Terrace House | $3.5 million – $5 million+ | ~7% p.a. |

| Semi-Detached | $5 million – $8 million+ | ~7-8% p.a. |

| Bungalow/GCB | $15 million – $30 million+ | ~8-10% p.a. |

The gap between HDB/condo and landed has never been wider. A young family upgrading from a resale HDB to a condo faces a stretch: but it’s doable with careful planning. The leap from condo to landed? For most, it’s now a chasm.

If you’re exploring what’s still within reach, you might want to check out our guide on affordable landed homes under $3.5M: but spoiler alert: options are slim.

The Social and Psychological Impact

Beyond the numbers, there’s a deeper, more emotional story playing out.

Generational Frustration

For many Singaporeans in their 30s and 40s, watching landed home prices soar has been demoralising. Their parents’ generation could realistically aspire to a terrace or semi-D with hard work and savings. Today, even dual-income professionals earning $20,000/month combined may struggle to qualify for: or sustain: a landed mortgage.

Shifting Aspirations

The definition of “success” in Singapore property is quietly changing. Where once a landed home was the goal, many younger families are now recalibrating: a well-located condo, a spacious resale HDB, or even a cluster house (which offers landed-style living without the full landed price tag) is now the new “dream.”

The Wealth Divide

Perhaps the most uncomfortable truth: landed homes have become a marker of inherited wealth as much as earned success. Many new landed homeowners in 2026 are not first-generation buyers: they’re inheriting, receiving family gifts, or pooling multi-generational resources. For those without family wealth, the door is largely closed.

What Does This Mean for You?

If you’re a young Singaporean family, a mid-career upgrader, or simply someone curious about property, here’s the honest takeaway:

- Landed homes are now ultra-luxury. Unless you’re in the top 5-10% of earners (or have significant family wealth), a traditional landed home is likely out of reach.

- Alternatives exist: but require compromise. Cluster houses, executive condos, and large resale HDB flats offer more space without the landed price tag. Explore your options with realistic expectations.

- Location matters more than ever. If you’re set on landed living, suburban and fringe areas (think Yishun, Sembawang, or Pasir Ris) offer lower entry points: but prices are rising there too.

- The market isn’t slowing down. With landed property growth outpacing overall private home prices, waiting is unlikely to improve affordability. If anything, the gap will widen.

For a broader look at where property investment still makes sense in 2026, check out our analysis on the best Singapore districts for property investment.

The Bottom Line

The Singapore Dream of landed home ownership isn’t dead: but it’s been fundamentally redefined. What was once an attainable aspiration for the middle class has become a privilege reserved for a shrinking elite.

For most Singaporeans, the path forward is about recalibrating expectations, exploring creative alternatives, and making peace with the fact that “making it” in property might look different than it did for our parents’ generation.

That’s not defeat: it’s realism. And in a market as dynamic and constrained as Singapore’s, realism is your most valuable asset.

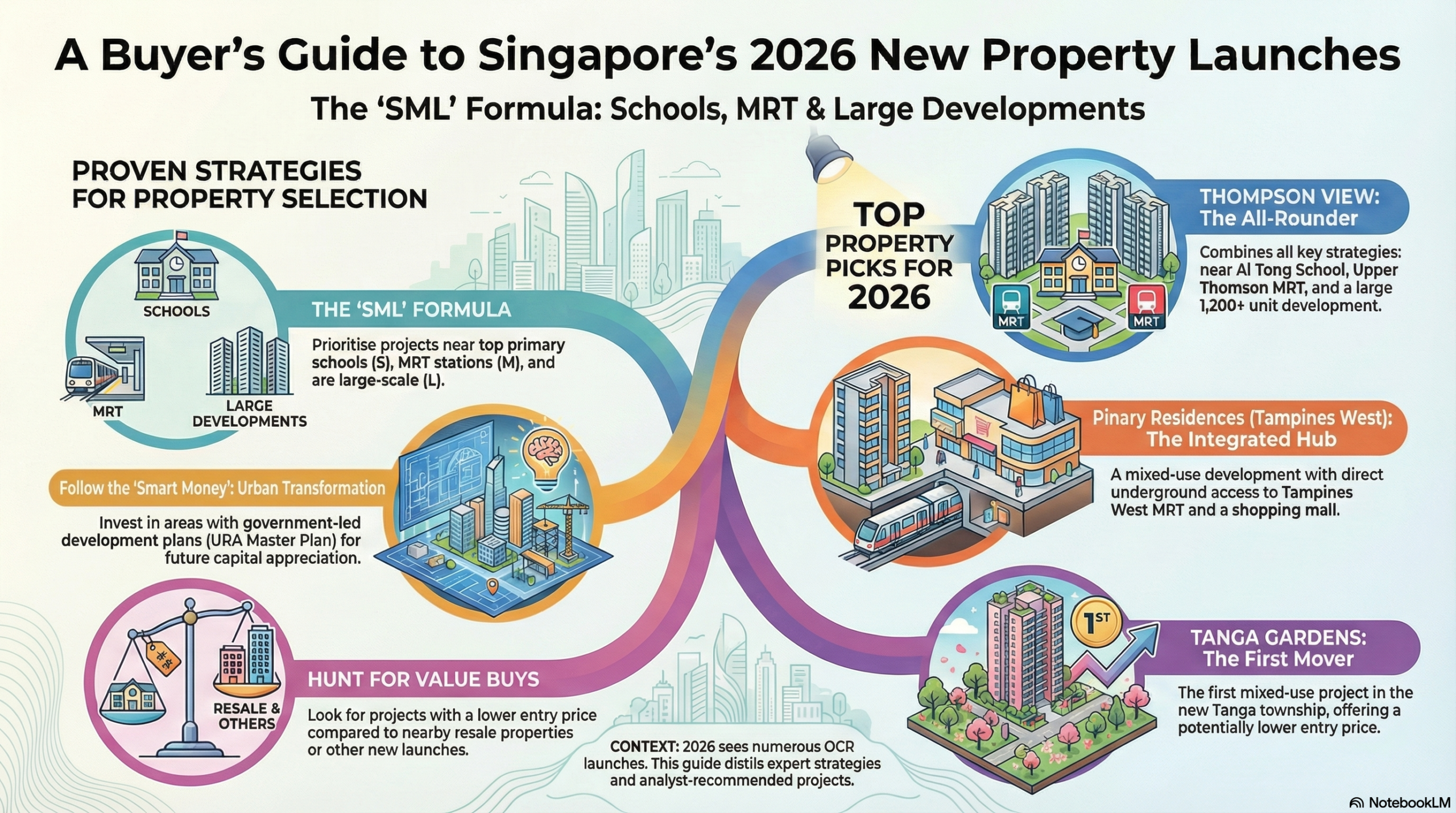

Thinking about your next property move? Browse our latest guides on Singapore’s 2026 new property launches for options that might suit your budget and lifestyle.

RELATED POSTS

View all