Affordable landed homes under $3.5M? 2025 Guide

August 9, 2025 | by nearme.sg

Introduction: A Scarce Opportunity

Only 5 % of Singapore’s housing stock is made up of landed homes, and the truly affordable ones are disappearing fast. In the post‑pandemic era, families have rediscovered the appeal of space and privacy. With more people working from home and pursuing hobbies that demand room to breathe, a ground‑floor garden or rooftop terrace suddenly feels less like a luxury and more like a necessity. Yet, with limited supply and strong demand, the entry ticket into the landed market has steadily moved upwards. This guide uncovers the neighbourhood pockets where freehold or 99‑year terrace houses and semi‑detached homes can still be found for under S$3.5 million – sometimes for the price of a large four‑bedroom condominium.

Why Landed Homes Are So Scarce

Singapore’s housing stock comprises about 73,100 private landed homes, 297,800 private non‑landed units and roughly 1.3 million public flats. Put another way, landed properties form roughly 19 % of private housing and just 5 % of total housing. Within the landed segment, there are three key types:

- Terrace houses – Inter‑terraces and corner terraces share party walls. Typical land plots range from 1,500–2,000 sq ft with built‑up areas of around 2,200–2,600 sq ft across two or three storeys. Corner terraces enjoy a side garden and command a premium.

- Semi‑detached houses – Pair‑of‑two homes with a common wall and land plots from 2,200–3,500 sq ft. They offer wider frontage and more garden space.

- Detached/Bungalows – Standalone houses occupying land parcels above 4,000 sq ft with total independence. Detached homes rarely fall below the $3.5 million mark in today’s market.

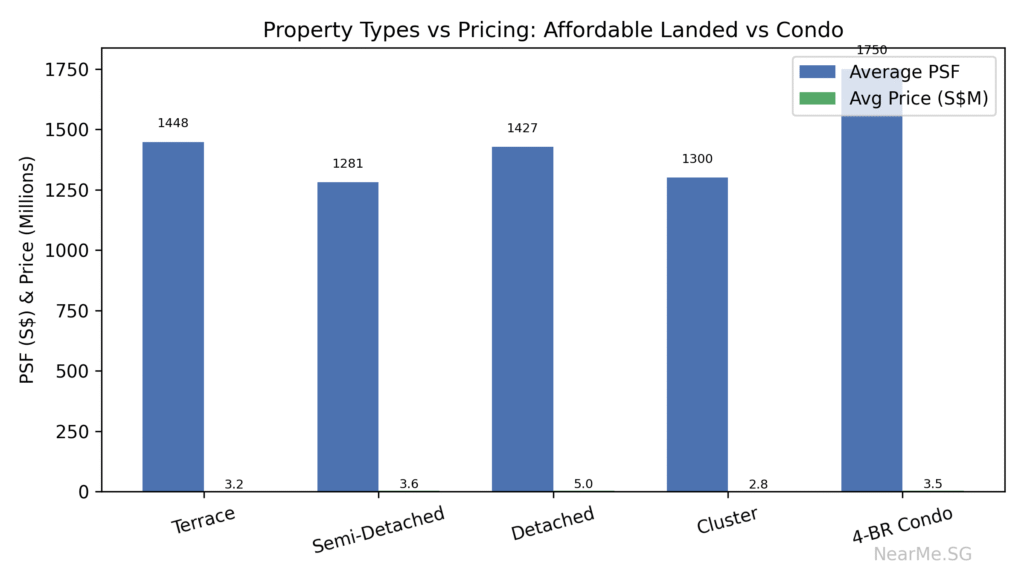

Because the government rarely releases new landed housing plots, most landed supply comes from older freehold estates (Terrace and semi‑detached homes built in the 1970s–1990s) or from strata‑titled cluster homes. This scarcity means prices have historically trended upward; between 2018 and mid‑2021, median land‑area prices for terrace houses climbed ~9.7 % to S$1,448 psf, semi‑detached houses rose 10.5 % to S$1,281 psf, and detached homes gained 9.6 % to S$1,427 psf.

Where to Find Landed Homes Under $3.5 M

While core central districts like Bukit Timah (D10/11) and East Coast’s Katong (D15) command stratospheric prices, several suburban clusters still offer entry‑level landed homes. Prices vary by tenure (99‑year vs freehold), proximity to MRT stations, land size and renovation condition. Below are neighbourhoods where inter‑terrace or semi‑detached houses have transacted within S$2.6–3.5 million in 2024–2025.

1 Sembawang & Yishun (District 27)

- Property types: Mostly 99‑year terraced houses from the late 1990s (e.g. Sembawang Springs, Springside), new strata clusters like Watercove and The Nautical. Land sizes around 1,600–1,900 sq ft.

- Transport: Canberra and Sembawang MRT stations (North‑South Line), upcoming North‑South Corridor and bus interchange. Yishun has an integrated transport hub with Northpoint City mall.

- Amenities: Near Sembawang Park and cycling paths, Sun Plaza and Chong Pang Market. Schools like Wellington Primary and Naval Base Secondary. Future developments include the Woodlands Regional Centre and North Coast Innovation Corridor.

- Indicative pricing: Older inter‑terraces have transacted around S$2.6–3.2 million, offering land ownership for the price of a mass‑market condominium.

2 Seletar Hills & Yio Chu Kang (District 28)

- Property types: Freehold inter‑terraces and semi‑detached houses in Seletar Hills Estate, Luxus Hills and Gerald Drive. Many were built in the 1980s–2000s and offer land plots of 1,600–2,200 sq ft.

- Transport: Served by Ang Mo Kio and Yio Chu Kang MRT stations on the North‑South Line; the upcoming Cross Island Line (CRL) will introduce Serangoon North and Tavistock stations nearby, dramatically shortening commutes to the CBD.

- Amenities: Proximity to Greenwich V and Seletar Mall, eateries along Jalan Kayu, and international schools at the Seletar Aerospace Park. Green spaces include the Seletar Reservoir Park and Lower Seletar Reservoir.

- Indicative pricing: Freehold terraces in this enclave have changed hands between S$3.0–3.5 million, with corner plots commanding premiums.

3 Kovan & Serangoon Garden (District 19)

- Property types: Mature freehold estates comprising inter‑terrace and semi‑detached houses around Jalan Labile, Poh Huat Road and Serangoon Garden Way. Land sizes range 1,500–2,400 sq ft. Cluster homes such as Parkwood Collection offer new options with condominium‑like facilities.

- Transport: Kovan, Hougang and Serangoon MRT stations (North East and Circle Lines), plus the future CRL Serangoon North station. Easy access to the Kallang‑Paya Lebar Expressway (KPE).

- Amenities: Nex mega‑mall, Heartland Mall and the dining enclave at Serangoon Gardens, as well as schools like Rosyth and Xinmin Primary. Chomp Chomp Food Centre anchors the community vibe.

- Indicative pricing: Ageing inter‑terrace houses in original condition have traded around S$3.1–3.4 million, while renovated homes and semi‑detached units fetch higher.

4 Jurong West, Hillview & Bukit Batok (Districts 22 & 23)

- Property types: Limited pockets of landed housing exist in the west. 99‑year terraced houses in Teban Gardens and Hong Kah have land sizes 1,500–1,700 sq ft. Cluster homes at Hillview Park (e.g. Hillview Garden Estate, Glendale Park) offer strata landed living with shared facilities.

- Transport: Jurong Region Line (2027–2029) will connect residential estates to the Jurong Lake District. Bukit Batok and Hillview stations on the Downtown Line provide access to the city.

- Amenities: Jurong Lake Gardens, West Mall, IMM and the upcoming Jurong Innovation District. Schools like Rulang Primary and Millennia Institute.

- Indicative pricing: Older inter‑terraces in the west remain among the most affordable, with transactions around S$2.5–3.0 million depending on tenure and condition.

5 East Coast Pockets (Districts 16 & 17)

- Property types: Freehold terraces and semi‑detached homes along Upper East Coast Road, Lucky Heights, Eastwood and the Jalan Singa/Jalan Punai enclave. Land parcels are typically 1,600–2,100 sq ft.

- Transport: Thomson‑East Coast Line brings Bayshore and Sungei Bedok stations by 2024–2025, while the Downtown Line extension will connect to Expo. Easy access to East Coast Parkway (ECP).

- Amenities: Eastwood Centre, Bedok Food Centre, Simpang Bedok and recreational options at East Coast Park. Schools include Temasek Primary and Victoria School.

- Indicative pricing: Older freehold inter‑terraces have been sold between S$3.0–3.5 million. Cluster homes like East Coast Residences provide strata alternatives with security and pools.

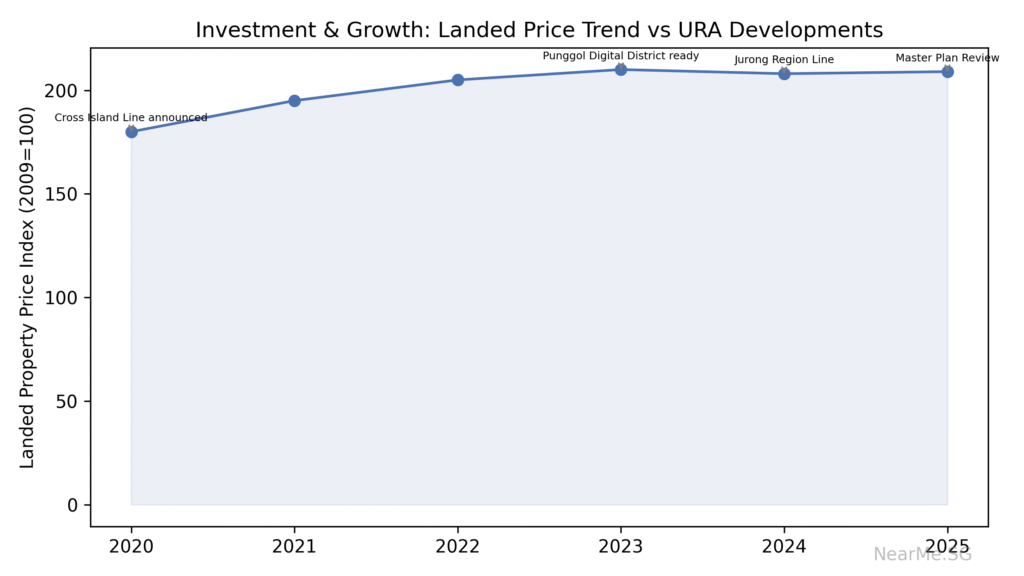

Pricing & Market Trends

The landed housing market has been resilient despite economic headwinds. URA statistics released in Q1 2025 show that the overall private property price index rose 0.8 % quarter‑on‑quarter; non‑landed home prices increased 1 %, while landed property prices rebounded 0.4 % after a slight dip in late 2024. In prior years, landed prices saw healthy gains: from 2018 to 2021, semi‑detached houses’ median price per square foot on land climbed 10.5 % to S$1,281 psf, terraces grew 9.7 % to S$1,448 psf, and detached homes rose 9.6 % to S$1,427 psf.

Comparatively, mass‑market condominiums (Outside Central Region) were transacting around S$1,500–1,900 psf in 2024–2025. This means that for the price of a large four‑bedroom condo costing ~S$3–3.5 million, buyers can own 1,600–2,000 sq ft of land – along with the freedom to rebuild or extend in future. Freehold and 999‑year landed homes tend to command premiums over 99‑year properties, but the scarcity of perpetual tenure is a strong hedge against lease decay.

Property Types & Layouts Explained

When evaluating affordable landed options, consider how the property’s configuration aligns with your lifestyle:

- Inter‑Terrace Houses – Typically two storeys with 3–4 bedrooms. Narrow frontages mean natural lighting is via front/back and internal courtyards. Renovations can reconfigure space or add an attic. Entry‑level inter‑terraces (<S$3.5 M) are usually 20–30 years old.

- Corner Terraces – Larger side yards provide more gardening space and flexibility for extensions. These command premiums of 5‑15 % over inter‑terraces but remain under S$3.5 million in outer suburbs.

- Semi‑Detached Houses – Often three storeys with 4–5 bedrooms. Wider frontages allow side windows for better ventilation. Prices below S$3.5 million exist mainly for 99‑year homes in western or northern estates.

- Cluster/Strata Landed Homes – Multiple houses share communal facilities and are managed like condominiums. Maintenance fees apply, but you get security and amenities (pool, gym). Sizes range 3,000–3,500 sq ft built‑up with small private yards. Prices ~S$2.8–3.3 million in projects like Belgravia Villas or Watercove.

Buyer Profiles & Demand Drivers

Most buyers of sub‑$3.5 million landed homes fall into two camps:

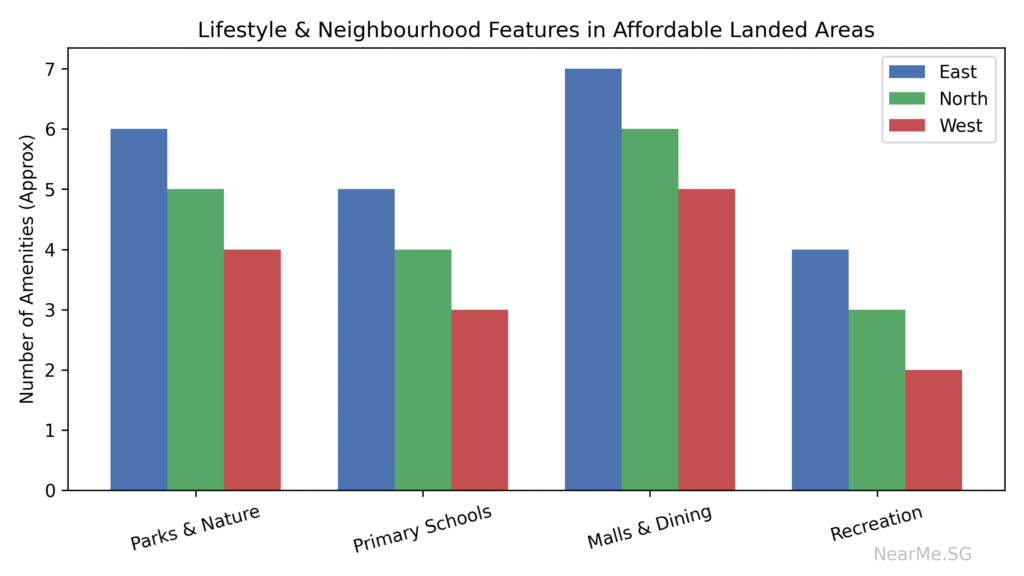

- HDB Upgraders & Condo Owners Seeking Space – These buyers often have young families and value outdoor space for children or pets. They are willing to trade condo facilities for land ownership and the absence of monthly MCST fees. Many prefer to remain in familiar neighbourhoods, which is why estates surrounded by HDB towns (e.g. Hougang, Ang Mo Kio, Bishan, Tampines) enjoy constant demand.

- Investors & Land Bankers – Investors recognise the scarcity of landed homes and view them as a wealth‑preservation asset. The ability to rebuild or add floors under URA guidelines allows for future value creation. Investors often target freehold districts with upcoming MRT lines, banking on gentrification and higher rental yields from expatriate families.

Investment & Growth Potential

Beyond the inherent scarcity of landed supply, several macro factors enhance the investment case:

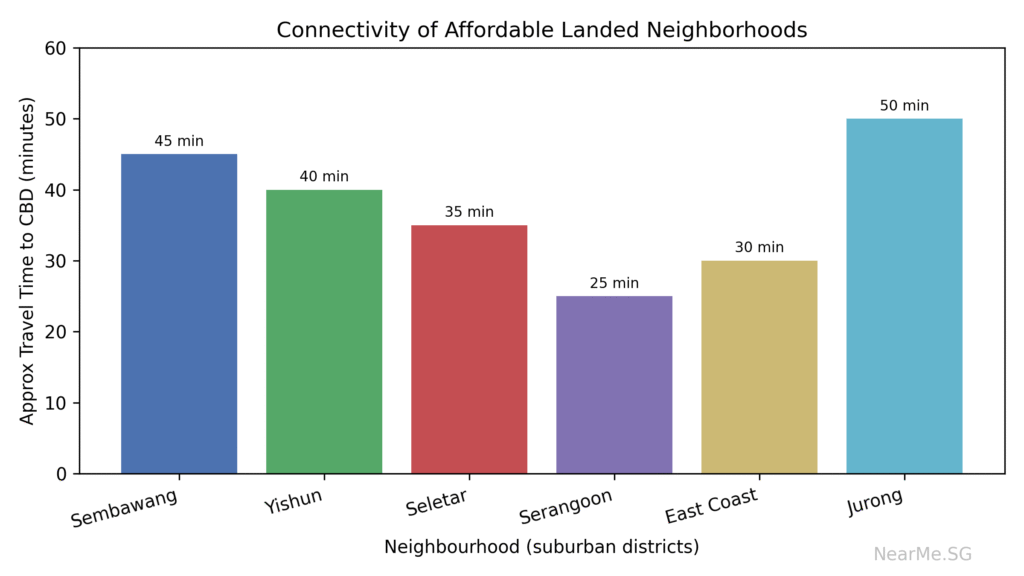

- Transport Infrastructure – New lines such as the Cross Island Line (CRL), Jurong Region Line (JRL) and Thomson‑East Coast Line (TEL) will open between 2024 and 2030, drastically improving connectivity for fringe estates. For example, the CRL station at Tavistock will shave travel to the city from Seletar to about 25 minutes.

- Master Plan Upgrading – URA’s 2019 and 2024 Master Plans earmark the Woodlands Regional Centre, Punggol Digital District, Jurong Lake District, and Bayshore/Bedok South as growth nodes. Homes near these precincts could see capital appreciation as commercial and employment clusters mature.

- Estate Renewal & Gentrification – Older estates like Serangoon Garden, East Coast (Siglap/Lucky Heights) and Hillview are undergoing rejuvenation as original owners sell to younger families who modernise the houses. Hip cafés, international schools and community parks are reinvigorating these neighbourhoods.

- Limited New Supply – Government land tenders for landed housing are few and far between. With most existing landed plots already developed, any increase in demand has an outsized impact on prices. URA data showing a rebound of 0.4 % in landed prices in Q1 2025 underscores the market’s resilience.

Conclusion: Owning Land Without Overspending

Owning a slice of land in land‑scarce Singapore is no longer reserved for multi‑millionaires. By venturing beyond the usual prime districts and considering older inter‑terrace homes or well‑maintained cluster houses, savvy buyers can unlock the freedom of landed living at condominium‑level budgets. With upcoming MRT projects shortening commutes and estate renewal breathing new life into suburban pockets, the next few years could offer an attractive entry window. Whether you’re an upgrader craving space or o an investor seeking a scarce asset, the pockets highlighted above prove that affordable landed homes still exist – if you know where to look.

Ready to explore your options? Contact our team at NearMe.SG for a personalised shortlist of landed listings under $3.5 million tailored to your preferred districts and lifestyle needs.

RELATED POSTS

View all