Thomson View Condo by UOL & CapitaLand: Free Expert Review

January 8, 2026 | by nearme.sg

Thomson View Condo the Powerhouse

When it comes to Singapore’s property market, few launches command as much attention as a mega-development in a mature estate. The new Thomson View Condo, a joint venture between real estate heavyweights UOL Group and CapitaLand, is poised to be the defining launch of 2026.

Located atop a sprawling elevated site in District 20, this redevelopment of the former Thomson View site offers a rare convergence of three critical property pillars: Prestigious Education (Ai Tong), Mass Transit Connectivity (TEL/CRL), and Nature (MacRitchie Reservoir). Whether you’re a family seeking a forever home or an investor looking for a defensive asset in the Rest of Central Region (RCR), this in-depth review breaks down why Thomson View is the project to watch—and how it could fit into your portfolio.

The Developers: A Powerhouse Partnership

When UOL Group and CapitaLand join forces, the market pays attention.

- UOL Group: Renowned for their “Masterpiece” collections (think Meyer House and Pinetree Hill), UOL is arguably Singapore’s best developer for landscaping and high-end finishes. They excel in biophilic design—integrating architecture seamlessly with nature for everyday livability.

- CapitaLand: One of Asia’s largest diversified real estate groups, CapitaLand brings robust construction standards, efficient layout planning, and strong mall management expertise (especially relevant with Thomson Plaza right across the road).

Why this matters: In a high-interest-rate environment, buying from reputable developers safeguards both build quality and the safety of your progressive payments—peace of mind you can bank on.

Location & Connectivity: The “Holy Trinity” of Real Estate

The new Thomson View sits on a massive plot of approximately 501,000 sq ft along Upper Thomson Road. For starters, its location attributes are near perfect for the modern Singaporean lifestyle.

- Transport Connectivity

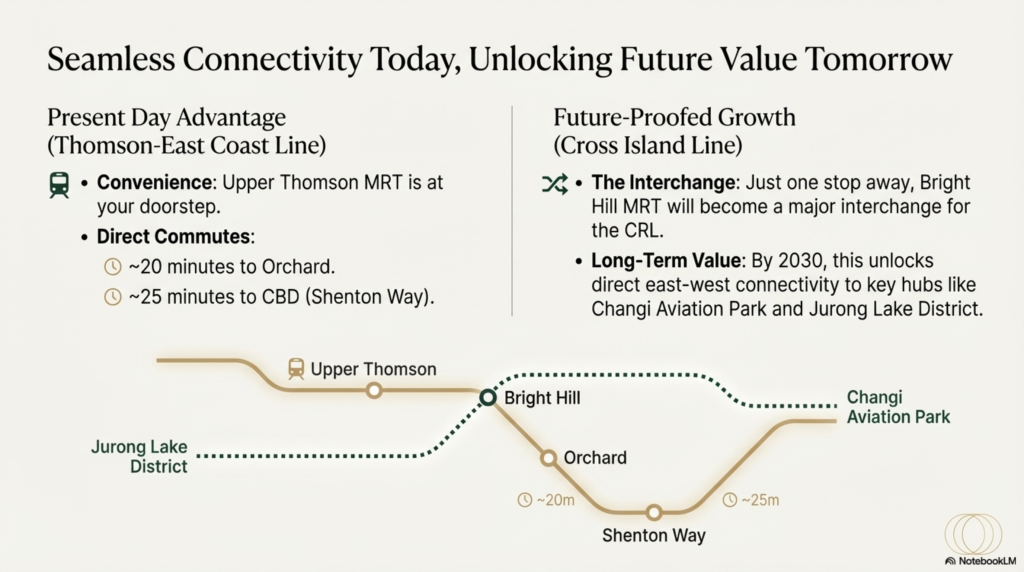

- Doorstep convenience: Upper Thomson MRT (Thomson-East Coast Line) is right at your feet.

- To Orchard: ~20 minutes direct train ride.

- To CBD (Shenton Way): ~25 minutes direct train ride.

- Future Interchange: Just one stop away, Bright Hill MRT is transforming into a major interchange for the Cross Island Line (CRL). By 2030, this unlocks direct east–west connectivity to Changi Aviation Park and Jurong Lake District (a big deal for long-term value).

- The Ai Tong Advantage

- Within 1km of Ai Tong School—one of Singapore’s most sought-after SAP primary schools.

- Other nearby schools: Catholic High School, Raffles Institution, Raffles Girls’ School, and Eunoia Junior College are all within a short drive or train ride—perfect for long academic pathways.

- Nature & Amenities

- The site backs directly onto MacRitchie Reservoir’s nature trails, offering unblocked greenery and immediate access to hiking paths (weekend recharge sorted).

- Directly across the street: Thomson Plaza with supermarkets, banking, tuition centers, and a wide array of F&B options—daily convenience without the commute.

Architecture & Facilities: Resort Living on a Hill

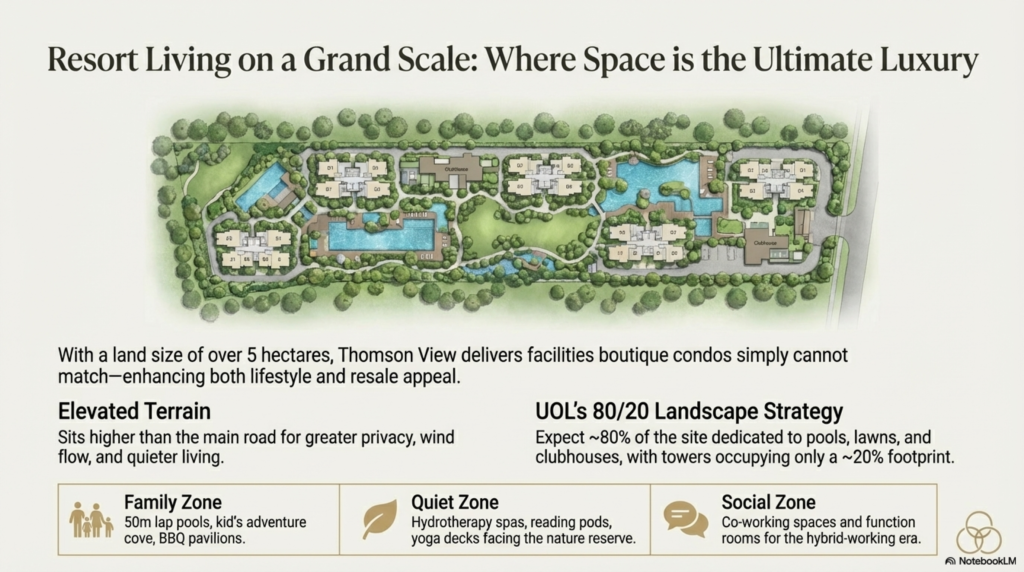

With a land size of over 5 hectares and an estimated 1,240 units, Thomson View embraces the “Mega-Development” concept. Larger plots let developers deliver facilities boutique condos simply can’t match—good for both lifestyle and resale appeal.

Key Design Features:

- Elevated Terrain: The site sits higher than the main road for privacy, wind flow, and quieter living.

- 80/20 Landscape Strategy: Expect UOL to dedicate nearly 80% of the site to pools, lawns, heritage trees, and clubhouses, with towers occupying only ~20% of the footprint.

- Zoned Facilities:

- The Family Zone: 50m lap pools, kid’s adventure cove, BBQ pavilions.

- The Quiet Zone: Hydrotherapy spas, reading pods, yoga decks facing the nature reserve.

- The Social Zone: Co-working spaces and function rooms built for the hybrid-working crowd.

Unit Mix & Floor Plan Analysis

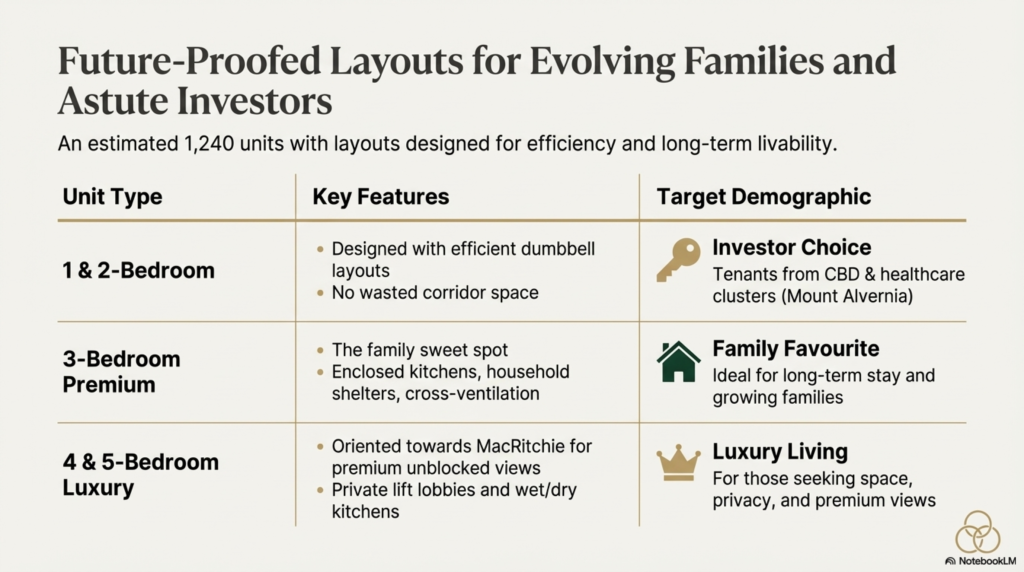

Layouts are expected to be “future-proofed” for evolving family needs and efficient rental performance.

- 1-Bedroom & 2-Bedroom: Efficient dumbbell layouts (no wasted corridor space)—ideal for investors targeting tenant pools from the CBD and nearby healthcare clusters (e.g., Mount Alvernia).

- 3-Bedroom Premium: The sweet spot for families—look for enclosed kitchens, household shelters (store), and cross-ventilation.

- 4-Bedroom & 5-Bedroom Luxury: Likely oriented towards MacRitchie for unblocked views; expect private lift lobbies and wet/dry kitchens.

Investment Analysis: The Numbers Game

Let’s talk numbers—because your entry price and exit strategy matter.

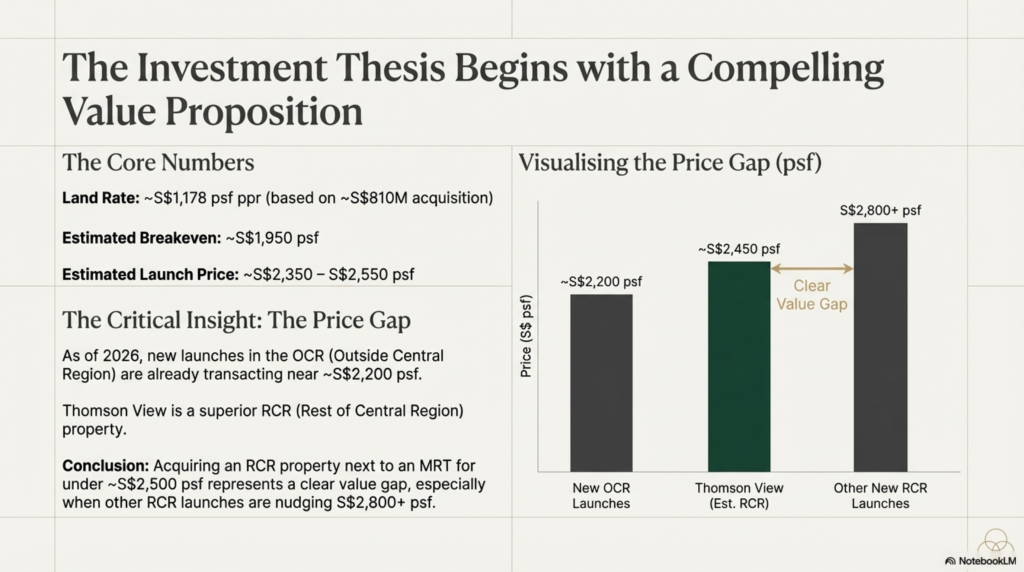

Entry Price vs. Breakeven

- Site Acquisition: ~S$810 million, translating to an estimated land rate of ~S$1,178 psf ppr.

- Estimated Breakeven: ~S$1,950 psf.

- Estimated Launch Price: ~S$2,350–S$2,550 psf.

The Price Gap

- As of 2026, new launches in the OCR (e.g., Clementi, Bedok) are already transacting near ~S$2,200 psf.

- Thomson View sits in the RCR.

- Buying an RCR property near an MRT for under ~S$2,500 psf represents a clear value gap—especially versus other RCR launches nudging S$2,800+ psf.

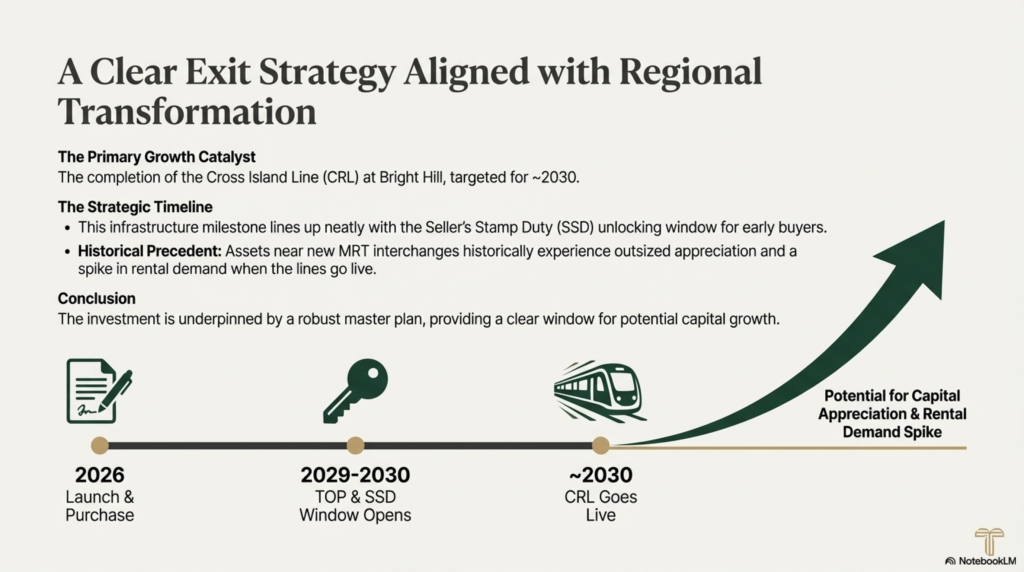

The Exit Strategy

- The area’s master plan is robust. The CRL’s completion around 2030 lines up neatly with the Seller’s Stamp Duty (SSD) unlocking window for early buyers—historically, assets near new MRT interchanges see outsized appreciation when lines go live (rental demand tends to spike too).

Summary: Should You Buy Thomson View?

Pros:

- Rare Scale: Large land plots in mature D20 are almost extinct.

- Ai Tong Factor: Keeps resale demand structurally high.

- Developer Reputation: UOL & CapitaLand = premium product confidence.

- Nature Integration: A unique selling point that’s hard to replicate.

Cons:

- Traffic: Upper Thomson Road can be congested during peak hours (MRT mitigates this for commuters).

- Supply: 1,240 units is sizeable; early rental competition within the condo may be higher.

Conclusion

Thomson View represents one of the most balanced assets launching in 2026. It marries the emotional pull of a nature-inspired family home with the hard logic of investment potential—via MRT connectivity and top-tier school proximity. If you missed the boat on Jadescape, this could be your second chance to own a landmark in District 20.

Ready to Explore Thomson View?

Direct Developer Sales Team—don’t miss the VVIP Preview. Register your interest today to receive:

- Full E-Brochure & Floor Plans

- Direct Developer Price List

- Priority Booking Slot

Want to compare across districts and sharpen your entry strategy? Check out our comprehensive property investment guide and our in-depth review of 2026’s new launches—then come back to lock in your viewing slot while the best stacks are still on the table.

Frequently Asked Questions (FAQ)

What are the key project details (developer, tenure, TOP)?

- Developer: UOL Group & CapitaLand Development (joint venture)

- Tenure: 99-year leasehold

- Estimated TOP: 2029–2030 (subject to final approvals and construction progress)

- Units: ~1,240 across 1- to 5-bedroom configurations

How do I book a showflat visit or get the e-brochure?

- You can register for the VVIP Preview and request the full e-brochure and floor plans via our team. Submit your interest here: 2026 New Launches VVIP List or contact us directly: NearMe.SG Contact.

- What you’ll need: NRIC/passport, your preferred unit types/budget, and (ideally) an Approval-In-Principle (AIP) from your bank to secure priority booking.

- What to expect: A guided showflat tour, price guide briefing, stack/unit matching, and a booking appointment during preview if you’re ready.

What’s the expected entry price and how does the payment timeline work?

- Indicative launch price: ~S$2,350–S$2,550 psf (aligned with our investment section’s estimates).

- Typical progressive payment for new launches (private property):

- 5% booking fee (cash) upon Option.

- 15% upon exercising the Sale & Purchase Agreement (within 8 weeks; cash/CPF).

- 10% at foundation completion.

- 10% at reinforced concrete framework completion.

- 5% at brick walls completion.

- 5% at ceiling completion.

- 5% at M&E/carparks/roads completion.

- 25% upon TOP.

- 15% upon CSC.

- Don’t forget to budget Buyer’s Stamp Duty (and ABSD if applicable) upon exercising the S&P.

Which schools are within 1km?

- Ai Tong School is within the coveted 1km radius (priority enrollment zone). Distance bands are determined by MOE at the time of registration; always verify the latest school distance maps before P1 registration.

- Other top schools nearby (short drive/train): Catholic High School, Raffles Institution, Raffles Girls’ School, Eunoia Junior College.

What’s the nearest MRT and what about bus options?

- Nearest MRT: Upper Thomson (TEL) at your doorstep.

- 1 stop to Bright Hill (TEL, future CRL interchange by ~2030) for direct east–west connections.

- Multiple bus services run along Upper Thomson Road and Bright Hill Drive, giving you quick hops to Bishan, Marymount, and the city.

What facilities are included—and are pets allowed?

- Expect zoned facilities across Family, Quiet, and Social zones: 50m lap pools, kids’ adventure cove, BBQ pavilions, hydrotherapy spas, reading pods, yoga decks, co-working lounges, and function rooms.

- Pets: Generally allowed in private condos, subject to MCST by-laws and AVS regulations (size/breed limits may apply). Always check the final by-laws before purchase.

What’s the rental demand and investment outlook?

- Strong tenant pools driven by: doorstep MRT (TEL), future CRL interchange, proximity to Ai Tong and top-tier schools, plus nature access at MacRitchie.

- Value gap: RCR, MRT-side living at sub-~S$2,500 psf offers compelling entry versus RCR peers pushing S$2,800+ psf.

- Exit angle: CRL completion (~2030) historically supports capital appreciation around interchange go-live—nicely aligning with SSD expiry for early buyers.

- Note: With ~1,240 units, initial internal rental competition may be higher, but mega-developments typically sustain demand thanks to comprehensive facilities and convenience.

How much are maintenance fees likely to be?

- Indicative monthly ranges (to be confirmed by the final MCST budget):

- 1–2 Bedroom: ~S$280–S$380

- 3 Bedroom: ~S$380–S$520

- 4–5 Bedroom: ~S$520–S$700+

- Larger units and premium stacks generally carry higher share values (and therefore higher monthly contributions).

What about parking, security, and visitor entry?

- Parking: Expect resident lots with EV-charging provisions (final ratio TBC at launch). Visitor lots typically provided within the development.

- Security: 24/7 guardhouse, CCTV in common areas, and card-access to lobbies/facilities are standard for UOL/CapitaLand builds.

- Visitor entry: Register at the guardhouse/intercom; access is controlled for resident safety and privacy.

Any unique features (smart home, eco features)?

- Smart home: Expect digital locksets, app-based facilities booking, parcel lockers, and selected smart controls (e.g., AC/heater)—specs to be confirmed in the brochure.

- Sustainability: Anticipate biophilic landscaping, energy-efficient fittings, solar-ready/common-area PV support, rainwater harvesting/irrigation efficiencies, and EV lots—consistent with the developers’ track records.

Ready to secure a slot? Lock in your VVIP appointment and price guide now via our 2026 new launches page or talk to us here: NearMe.SG Contact.

RELATED POSTS

View all